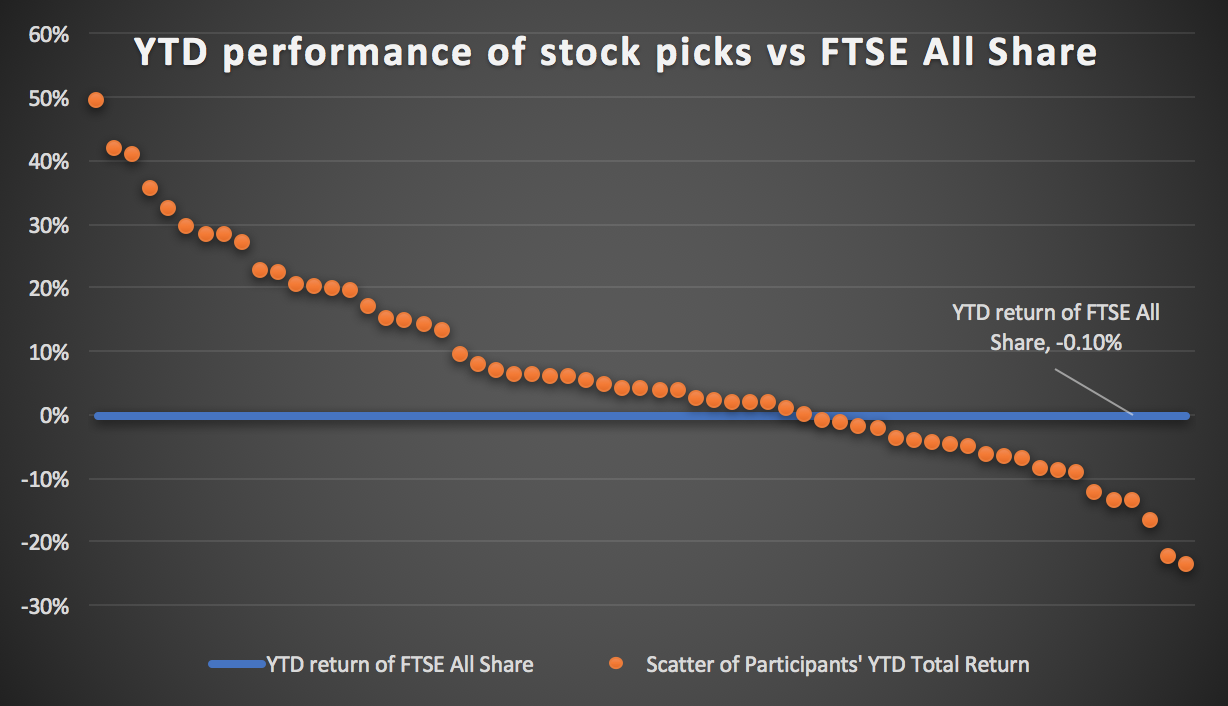

Whilst it's only early days, our users are already comfortably beating the market

Companies: DEBS, FEVR, IGR, JOUL, TRC

As explained below, here are some of Research Tree user's top picks in Bars & Eateries, Household Goods, and Clothing Retailer sectors for 2017.

At the tail-end of 2016, we asked our core users for their stock picks for 2017 and their associated rationales. We had a fantastic response, and after receiving some excellent insights from a group of very clued-up investors, we decided to share some in a series of articles.

As you can see, the picks as a group are significantly outperforming the FTSE All Share which is currently flat year-to-date, although it is admittedly still early days.

Our users are mostly Sophisticated or High Net Worth private investors, but we also have a growing number of professional investors and commentators.

We thought it would be a good idea to share some of their views and rationales. However, we got so many quality responses that we have had to split them broadly into sector groupings.

Below is a quick run through some of the picks in the Bars & Eateries, Household Goods, and Clothing Retailer sectors.

Bars & Eateries

The EU referendum brought significant uncertainty to the UK economy and UK retailers for the majority of 2016. However, despite this and a weakened Sterling, British consumers continued to spend after 23 June, with many pubs and restaurant chains releasing positive H2 results.

Revolution Bars (RBG) has been one of the most popular picks from our users going into 2017. Several said they chose RBG as the firm has a "retail roll-out that is fully funded from cash flow and no debt, each bar is profitable quickly and has good margins." Another commented:

"...the company pays a useful dividend and is valued on a PER of only 12/13 whereas 15-20 would be more appropriate.."

Those of you who have read the work of well-known small-cap investor and commentator Paul Scott will be quite familiar with the stock, which Paul has been discussing for the past 18 months. You can see his views on RBG here.

Household Goods

If you have a habit of buying stationary, you'll probably have come across products from IG Design Plc, the firm behind many retail stationery brands. IG Design is up a decent 18% since 30 December after increasing 30% in 2016, not too shabby at all.

One of our clued up users told us that he believes the company has been on a strong upward trajectory since appointing Paul Fineman as CEO:

"Their everything but the cake offering continues to gain traction, progress is being made in all areas and order books are 'heaving' with momentum increasing says the CEO. Debt is coming down and business performance should continue to improve. Rating has some headroom too."

Beaufort Securities recently covered IG Design in a note, with analyst Barry Gibb striking a positive tone but warning investors that he believes the shares will be held back until influential holder Miton Group has finished reducing its holding:

"This is unfortunate, given the operational progress the Group continues to make, having proven that its global expansion and acquisition strategies are working well. IG delivered financial performance ahead of expectations at the Interims and generated a strong order book, while upgrading its FY2017 expectations and increasing its full year dividend guidance to 4p per share (FY2016: 1.5p).

The shares are valued on FY2017E and FY2018E P/E multiples of 16.2x and 14.7x with dividend yields of 1.6% and 2.0%, respectively. Considering the successful acquisition of Lang Companies Inc., a highly complementary US-based supplier of quality gift and speciality products, on 11 July 2016, we believe the Group will further benefit from the strong performance of its US divisions (FY2016 revenue stood at 40% of the Group), further supported by positive currency translation effect."

Non-Alcoholic Drinks

Non-Alcoholic Drinks is probably not a sector in the universe of many investors, but one company from this sector has been wowing the market since late 2014 with exceptional growth: the much-loved brand of premium tonic water (and other mixers) Fevertree Drinks.

According to one of our users, FEVR is highly rated, well-managed, and has a track record of beating the market. (P.S it did it again today). Another said:

"... FEVR's PE is high but the PEG is only 3.2. Its unique selling point, niche premium products, is not affected by GBP weakness and the firm has USD exposure."

Since its IPO in November 2014, Fevertree Drinks has rocketed 600%. Despite being highly valued (forward P/E of 78.74) its addressable market is still large and management has a great track record of beating forecasts.

Clothes & Apparel

Clothes & Apparel was a mixed bag in 2016. Ecommerce provider boohoo.com was one of the most popular small cap stocks of the year, with its valuation rocketing, whilst Next ended up 30% below its pre-Brexit price after sales declined, leading to the firm warning against a hard-Brexit.

In this sector, one of our users chose Joules Group (JOUL) the British fashion and lifestyle retailer as his pick:

"JOUL as unique British products with multiple selling sources. Again not price sensitive through its brand recognition. But we are spoiled for choice at the moment."

-----

Read our users' picks across the other sectors here:

- Tech, Software, and Telecoms stocks for 2017

- Construction, Support Services, and Financial Services stocks for 2017

- Energy, Pharma, BioTech, and Publishing stocks for 2017

Please Note: This article is not intended to be advice or a recommendation to buy, sell or hold any investment mentioned, nor is it a research recommendation. Investors should form their own view in relation to any potential investment.

.png)