Thruvision, the international provider of walk-through security technology, has provided a short update on trading for the year ending 31 March 2025. The group’s diversified business model, with a broad customer base in a number of international markets, is continuing to bear fruit, with several significant opportunities totalling a potential contract value of £15m. However, orders, particularly in the Customs division, are inherently lumpy and while some of these material opportunities were expected to come through in Q4 FY25, discussions with associated customers suggest they will be predominantly in FY26. While the material order backlog remains intact, we reduce FY25E estimates to reflect the timing of these opportunities.

17 Feb 2025

PROGRESSIVE: Thruvision - Strategic Review continues

Sign up for free to access

Get access to the latest equity research in real-time from 12 commissioned providers.

Get access to the latest equity research in real-time from 12 commissioned providers.

PROGRESSIVE: Thruvision - Strategic Review continues

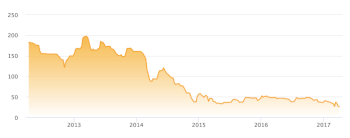

Thruvision Group PLC (THRU:LON) | 1.2 0 0.0% | Mkt Cap: 2.00m

- Published:

17 Feb 2025 -

Author:

Gareth Evans -

Pages:

4 -

.png)

Thruvision, the international provider of walk-through security technology, has provided a short update on trading for the year ending 31 March 2025. The group’s diversified business model, with a broad customer base in a number of international markets, is continuing to bear fruit, with several significant opportunities totalling a potential contract value of £15m. However, orders, particularly in the Customs division, are inherently lumpy and while some of these material opportunities were expected to come through in Q4 FY25, discussions with associated customers suggest they will be predominantly in FY26. While the material order backlog remains intact, we reduce FY25E estimates to reflect the timing of these opportunities.