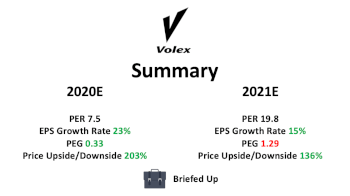

While the FY20 interims are in-line, this does not tell the whole story with the investment case for Volex evolving away from the recovery mode of the last few years to a growth business which now focuses on cash generative, higher margin customers in new markets. The business is substantially de-risked with the top three customers now accounting for 25% of revenues – down from 47% in FY15 and when combined with a re-iteration of our PBT growth forecast of 47% for FY20, an upgrade to ou

14 Nov 2019

Evolving investment case - the next phase

Sign up to access

Get access to our full offering from over 30 providers

Get access to our full offering from over 30 providers

Evolving investment case - the next phase

Volex plc (VLX:LON) | 258 2.6 0.4% | Mkt Cap: 477.0m

- Published:

14 Nov 2019 -

Author:

Andy Smith -

Pages:

12 -

While the FY20 interims are in-line, this does not tell the whole story with the investment case for Volex evolving away from the recovery mode of the last few years to a growth business which now focuses on cash generative, higher margin customers in new markets. The business is substantially de-risked with the top three customers now accounting for 25% of revenues – down from 47% in FY15 and when combined with a re-iteration of our PBT growth forecast of 47% for FY20, an upgrade to ou