This content is only available within our institutional offering.

20 Jul 2022

Bloomsbury Publishing : A stock for all seasons - Buy

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

Bloomsbury Publishing : A stock for all seasons - Buy

Bloomsbury Publishing Plc (BMY:LON) | 478 19.1 0.8% | Mkt Cap: 390.5m

- Published:

20 Jul 2022 -

Author:

Alastair Reid | Ross Broadfoot -

Pages:

6 -

AGM trading update: Bloomsbury has released another impressive trading update ahead of its AGM today – strong trading across the first four months of the financial year left sales up 27% yoy, demonstrating the resilience in the business and continuing its momentum from last year. The strong performance was seen across both divisions, with Consumer growing 26% (helped by Children’s at +34%) and Non-Consumer growing 30% (with Academic & Professional +49%). Notable bestsellers included Paul Hollywood’s Bake, and both the Harry Potter / Sarah J Maas series.

Outlook unchanged, for now: Management note that trading thus far has been in line with market expectations – whilst we recognise the broader macro-economic headwinds for consumers, Nielsen market data for UK book sales (with calendar H122 3% ahead of the previous record in H108) suggests that the structural increase in appetite for reading is permanent. We similarly expect the Academic & Professional division to continue benefiting from the structural uplift in potential customer numbers seen as a result of the pandemic.

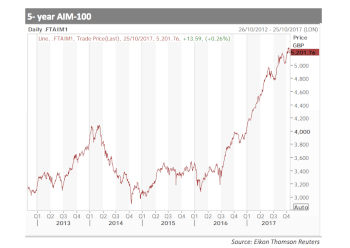

Plenty more to go for: We leave forecasts unchanged at this early stage of the year. Despite the impressive share price performance since pre-pandemic, the stock still trades at a modest c.7x calendar FY24E EBITDA (or 14x PE, even with net cash to deploy). With the portfolio demonstrating its increasingly resilient growth, and the Academic & Professional business still in the early stages of exploiting opportunities accelerated by the crisis, we see significant scope for re-rating over time.