This content is only available within our institutional offering.

26 Apr 2021

Bloomsbury Publishing : Academic opportunities - Buy

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

Bloomsbury Publishing : Academic opportunities - Buy

Bloomsbury Publishing Plc (BMY:LON) | 478 35.8 1.6% | Mkt Cap: 389.7m

- Published:

26 Apr 2021 -

Author:

Alastair Reid | Ross Broadfoot -

Pages:

6 -

Expanding academic publishing footprint: Bloomsbury on Friday announced the acquisition of academic publisher Red Globe Press (RGP), from Macmillan Education for a total consideration of £3.7m. RGP is focused on publishing in the Humanities & Social Sciences, with a backlist of >7k titles and publishing >100 new titles pa – importantly, it adds three digital products to Bloomsbury’s Digital Resources platform. RGP is expected to contribute revenue / PBT of £6.0m / £0.4m respectively to fiscal FY22, but we expect a return to normalised levels of revenue / profits for RGP in FY23 onwards. RGP generated revenue of £9.6m and PBT of £1.1m in calendar 2020.

Attractive opportunities: The Academic & Professional division now represents 32% of FY23E revenue, and this could increase further over time given the scope for more similar M&A, given we still assume a net cash position of c.£58m at YE22E. Not every acquisition may occur at quite such attractive multiples, but it is a reminder of the financial, as well as strategic, benefits Bloomsbury can target via M&A. From an underlying standpoint, recent commentary from peers like Informa highlights the underlying resilience of the academic publishing market, but the crisis has also accelerated structural shifts that should benefit Bloomsbury’s revenue growth over time – management have previously noted that c.1400k institutions trialled their Digital Resources product suite in H121, relative to c.500 in the whole of FY20.

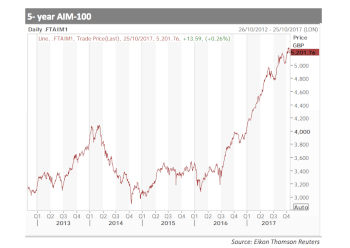

Upgrade momentum: We increase earnings by 2-4% in the medium-term, and this drives our target price increase to 340p. Despite the share price move on Friday, Bloomsbury still trades at <14x cal FY23E PE – in our view, this does not capture either the opportunity to deploy cash or the fundamental resilience and scale of its growth opportunities over time.