This content is only available within our institutional offering.

14 Feb 2024

Bloomsbury Publishing : It is the real life, it is the fantasy - Buy

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

Bloomsbury Publishing : It is the real life, it is the fantasy - Buy

Bloomsbury Publishing Plc (BMY:LON) | 478 19.1 0.8% | Mkt Cap: 390.1m

- Published:

14 Feb 2024 -

Author:

Alastair Reid -

Pages:

6 -

Always delivering: Bloomsbury have released another impressive trading update this morning - revenues and profits are expected to be significantly ahead of consensus expectations. This in large part reflects the exceptional performance of the Consumer division, where the latest Sarah J Maas release in late Jan has already reached the top of bestseller lists in the US, UK and Australia. Management note the broader beneficial impact this has had on backlist demand for her titles, and the six future titles already contracted.

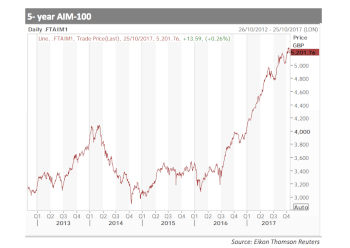

Growth potential builds: From a broader perspective, management highlight the growing strength of their footprint in the structurally expanding fantasy genre - this is only likely to continue, in our view, given the potential support from related TV / film productions likely to appear over the medium-term. The growing net cash position (INVe >£60m at YE) will provide support to further organic investment in content and inorganic expansion in Academic publishing. We expect further details on all these topics at the full results on May 23.

Fundamentally undervalued: Bloomsbury currently trades at <8x CY24E EBITDA – we continue to believe this is a significant mispricing given the resilient, accelerating growth the business can deliver over time. We increase revenues by 13% for FY24E and PBT by 31%, but leave forecasts for FY25E onwards broadly unchanged at this stage. Bloomsbury is one of our key sector picks for 2024.