This content is only available within our institutional offering.

09 Apr 2025

First Take: Bloomsbury Publishing - Keep calm and carry on

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

First Take: Bloomsbury Publishing - Keep calm and carry on

Bloomsbury Publishing Plc (BMY:LON) | 486 14.6 0.6% | Mkt Cap: 397.0m

- Published:

09 Apr 2025 -

Author:

Alastair Reid -

Pages:

4 -

Limited tariff impact

In recent days, trade press publication ‘The Bookseller’ has reported on the recent tariff announcements in the context of the publishing industry. It notes that printed books may be exempted from tariffs under the First Amendment, linked to freedom of expression, with printed books included in an annexe of exemptions within the tariff announcements. We would also note our belief that the vast majority of print books – particularly for major consumer titles – are printed locally in the US, albeit with just modest risk of increased input costs for any non-US sources of paper.

Fundamental resilience of demand

More generally, as investors consider the broader impact of dampened economic growth on companies, we would note the impressive underlying resilience of demand in Bloomsbury’s markets. Consumer publishing was very resilient through the financial crisis (reflecting that books provide significant value in terms of entertainment time relative to cost, when set against other activities), and saw demand strengthen through the pandemic – in part reflecting the importance of escapism in troubled times, which may well be relevant today. In Academic publishing, whilst institutional budget pressures linked to enrolment numbers have been flagged previously, we would note the counter-cyclical aspects of the US higher education market, with enrolment numbers historically accelerating in times of recession (particularly in the community college).

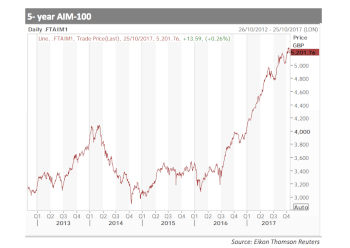

Mispriced equity

The shares have fallen c.19% thus far this year, broadly in-line with the likes of Informa (Buy, TP 950p) – we recognise the headwinds to sentiment across the wider market currently, but believe this is fundamentally unjustified given the likely lack of impact from tariffs and the structural growth that the business has as a result of its ‘virtuous flywheel’ (with content demand fuelling content acquisition to drive further demand). We believe Bloomsbury warrants a significantly higher valuation than the <7x CY25E EBITDA it trades at today, and it remains a key sector pick.