The FY21 numbers came in higher than expectations.

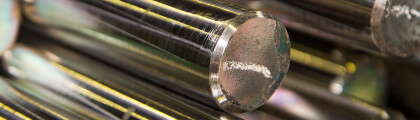

The recovery in drilling activity and OCTG prices in North America explain this performance.

The EBITDA margin is still on the rise despite higher input costs.

The net result is also boosted by the contributions from Ternium and Usiminas (steel makers, not consolidated).

Overall, a solid set of numbers and a reasonably positive outlook.

We will revise our numbers and valuation upwards after our target price has been reached.

17 Feb 2022

A solid Q4 21 and a reasonably positive outlook

Sign up to access

Get access to our full offering from over 30 providers

Get access to our full offering from over 30 providers

A solid Q4 21 and a reasonably positive outlook

- Published:

17 Feb 2022 -

Author:

Fabrice Farigoule -

Pages:

3 -

The FY21 numbers came in higher than expectations.

The recovery in drilling activity and OCTG prices in North America explain this performance.

The EBITDA margin is still on the rise despite higher input costs.

The net result is also boosted by the contributions from Ternium and Usiminas (steel makers, not consolidated).

Overall, a solid set of numbers and a reasonably positive outlook.

We will revise our numbers and valuation upwards after our target price has been reached.