This content is only available within our institutional offering.

25 Aug 2022

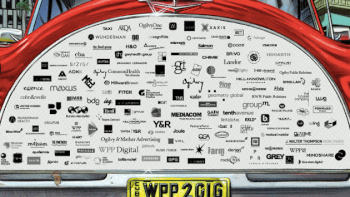

Mad Men meet the macro

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

Mad Men meet the macro

WPP Plc (WPP:LON), 294 | Publicis Groupe SA (PUB:PAR), 0 | Omnicom Group Inc (OMC:NYS), 0 | Omnicom Group Inc (0KBK:LON), 0 | Publicis Groupe SA (0FQI:LON), 0

- Published:

25 Aug 2022 -

Author:

Ghayor Lina LG | Packer William WP -

Pages:

72 -

You remember what happened in 2009. A big recession and a nasty hit to agency share prices. Why would you want to go there again?

Because while it won''t be easy, this time the Mad Men can take on the macro. We''ve built detailed pictures of EPS trajectories under recession, with granular work on the often-opaque world of revenue and cost streams, to uncover impressive and arguably overlooked resilience.

What''s more, we''re adding the US leaders to our European coverage, for global coverage of this global industry, with new benchmarks and in-depth read-across. Our top picks are Publicis (+) and Interpublic (+) on stronger organic growth supported by their progress on the pivot to higher quality revenue streams. WPP is (=) and Omnicom a relative Underperform.