This content is only available within our institutional offering.

05 Aug 2021

First Take: AB InBev - Why the sell-off?

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

First Take: AB InBev - Why the sell-off?

AB INBEV (ABI:EBR), 0 | Anheuser-Busch InBev SA/NV (ABI:BRU), 0 | Reckitt Benckiser (Bangladesh) PLC (RECKITTBEN:DHA), 0 | Reckitt Benckiser Group plc (RKT:LON), 5,862

- Published:

05 Aug 2021 -

Author:

Alicia Forry, CFA | Anthony Geard -

Pages:

7 -

Punishment does not fit the crime

AB InBev (ABI) is our preferred global consumer staples play (together with RKT LN, Buy) on account of its undemanding valuation (FY22E P/E of c. 16.7x) and high exposure to the strong recovery underway in emerging markets. So why the sell-off after H1 results that were only slightly short of expectations? In this note, we analyse ABI in the context of its brewing peers and also compare the investment narratives of the best (L’Oréal, OR, not rated) and worst (ABI) performing consumer stocks since the start of 2020 and analyse the factors that may explain the disparity.

Lagging the wider Consumer sector, especially L’Oréal, which delivers identical top-line growth

ABI has been the worst performing brewer and consumer staple name since the start of 2020: down 24% in USD vs Carlsberg (CARLB, not rated) +23% and Heineken (HEIA, not rated) +8%. On a forward P/E basis (FY22E), ABI’s 16.7x multiple is well below that of HEIA (24x) and CARLB (22x). This is despite better organic volume and sales growth relative to HEIA during the past five quarters and more resilient profitability; ABI’s trading margin compressed by 14% in FY20A, whereas that of HEIA narrowed by 27%.

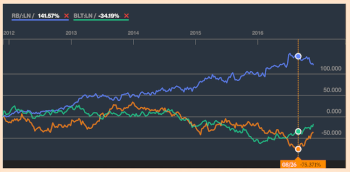

While the valuation gap between ABI and its brewing peers is hard for us to square, the widening valuation and share price performance between ABI and OR is startling. Since the start of 2020, OR has risen 59% in USD, while ABI has fallen 24%. Since the start of 2006, OR has risen by 496% in USD (excluding dividends), while ABI has risen by 133%.

Turning to valuation, we note that ABI traded at a modest discount (13% average on a trailing P/E basis) to OR from the start of 2013 to mid-2016. However, the valuation gap widened steadily from then and approached 50% toward the end of 2019; the average in the period from October 2016 to January 2020 (ratings became distorted after that by Covid-related share price volatility) was 27%. Looking forward, the current FY22E P/E rating of ABI at 16.7x reflects a >60% discount to OR on 42x. ABI’s forward EV/EBITDA multiple of 10.8x (FY21E) represents a similar-sized discount to OR’s 27.7x.

Continued overleaf