This content is only available within our institutional offering.

04 Aug 2025

UK Pubs: Pubs keep outperforming hospitality

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

UK Pubs: Pubs keep outperforming hospitality

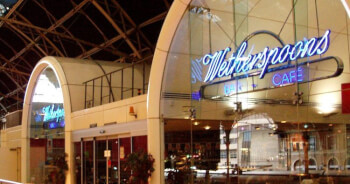

Mitchells & Butlers plc (MAB:LON), 263 | J D Wetherspoon plc (JDW:LON), 700 | Young & Co.'s Brewery, P.L.C. Class A (YNGA:LON), 740 | Fuller, Smith & Turner P.L.C. Class A (FSTA:LON), 689

- Published:

04 Aug 2025 -

Author:

Roberta Ciaccia | Harold Hutchinson -

Pages:

7 -

LFL sales for pubs were +1.2% yoy, vs flat for all managed outlets. The data reported on July 31st by CGA for managed hospitality groups in June shows that the market was flat yoy, due to a combination of mixed weather and tough comps (Euro 2024 men’s tournament took place in June last year). Within this context, pubs did outperform (+1.2%), while restaurants lagged behind (-0.5%) and bars kept drifting (-5.7%). Pubs have consistently outperformed other hospitality businesses for almost three years now, averaging +1.9% above the rest of the space since September 2022.

Listed pub groups have reported better than the relative index. The recent trading season has seen JD Wetherspoon (Buy, TP 900p) reporting +5.1% yoy LFL in the 12 weeks to 20 July, Fuller’s (Buy, TP 750p) +5.0% in the 16 weeks to 19 July, Young’s (Buy, TP 1350p) +7.0% in the 14 weeks to 8 July, Mitchells & Butlers (Buy, TP 340p) +5.0% for the 14 weeks ended 19 July and Marston’s (NR) +2.9% in the 15 weeks to 12 July. All of these companies have therefore outperformed the remainder of the managed pubs over the past weeks, again confirming a long-standing trend. We believe this is due to the superior ability of these groups to manage their price/volumes mix compared to independents, which still represent c65% of total sites in the UK, we estimate.

Cost pressures are high, but margins for larger operators can hold up. The government’s actions on labour costs, announced in Autumn 2024 and implemented in April this year, are expected to have a significant impact on the cost line for all pub operators, given how labour-intensive the sector is. However, all of the companies highlighted in this note have indicated some mitigating factors, both on the cost and on the revenue side, to reduce the impact of these measures on profits. As such, for all our covered stocks, we expect pre-tax profit margins to decrease only marginally in the current fiscal year, and to then recover progressively.

We continue to see good value for listed pubs. YNGA looks the most attractive in the short term. Despite the difficult environment, all of the companies in our pubs universe of coverage benefit from high levels of freehold ownership, pricing power, focus on a specific customer groups and solid financials. While they all look fundamentally attractive, we see Young’s as the most appealing in the short term. At 6.7x EV/EBITDA FY26E, Young’s shares are trading at a hefty 42% discount to their historical 2010-2019 average (vs. JDW at a 10% discount, Fuller’s at 28%, Marston’s at 25%, Mitchells & Butlers at 15%). This is despite having reported the best LFL in the last earnings update, with the lowest leverage and highest margins in the space.