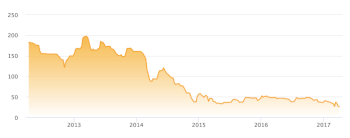

Thruvision has reported a very successful H1 of its FY20 year. Revenues were up 53% y/y to £4.8m based on a material increase in average selling prices, allowing the group to roughly halve its operating loss. Cash remains strong at £8.7m. We take the opportunity to introduce forecasts for the first time, at what we believe to be a cautious level, hopefully allowing scope for upgrades over time.

25 Nov 2019

High-end product driving strong performance

Sign up for free to access

Get access to the latest equity research in real-time from 12 commissioned providers.

Get access to the latest equity research in real-time from 12 commissioned providers.

High-end product driving strong performance

Thruvision Group PLC (THRU:LON) | 1.0 0 0.0% | Mkt Cap: 4.26m

- Published:

25 Nov 2019 -

Author:

Gareth Evans -

Pages:

5 -

.png)

Thruvision has reported a very successful H1 of its FY20 year. Revenues were up 53% y/y to £4.8m based on a material increase in average selling prices, allowing the group to roughly halve its operating loss. Cash remains strong at £8.7m. We take the opportunity to introduce forecasts for the first time, at what we believe to be a cautious level, hopefully allowing scope for upgrades over time.