Broker VSA Capital gives its view on the mining giants

Companies: Antofagasta plc, BHP Group Ltd

Mining giants BHP Billiton (LSE: BHP) and Antofagasta (LSE: ANTO), both published financial reports this morning, with results at the FTSE 100 companies showing that the mining sector continues to struggle with a slump in commodity prices.

BHP posted record losses as the group saw a $14bn decline in revenue and an $8.3bn swing in net income. Antofagasta surged 9% this morning as the significant slump in revenues was more than off set by impressive cost savings.

Record Losses for BHP

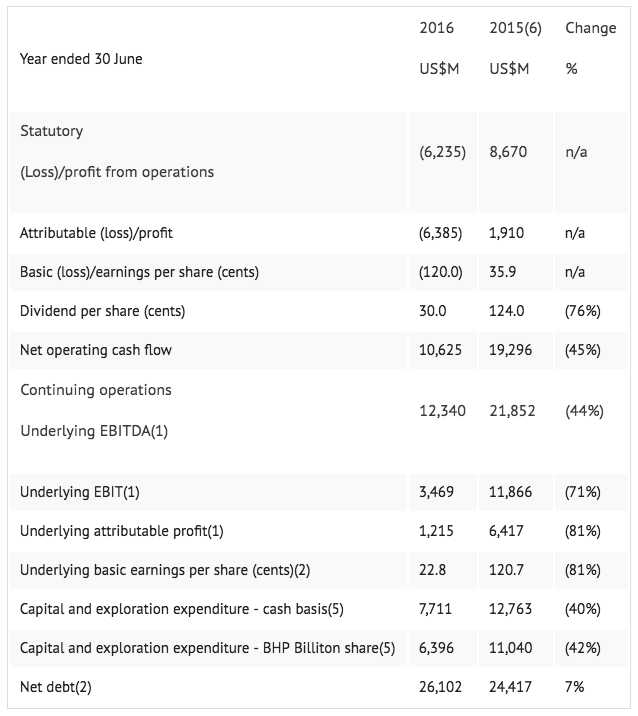

BHP Billiton (LSE: BLT) has delivered record losses for FY16, reporting a huge 30% fall in revenue ($14bn), underlying EBITDA down 44% at $12.34bn ($21.85bn FY15), and net cash flow down 45% at $10.63bn. The company has cut its dividend 76% to 30 cents per share (124 cents FY15), after flagging the change in dividend policy back in February.

The company has seen a significant fall in revenues as the major slump in commodity prices continues.

Broker VSA Capital said the weak results were largely due to weaker commodity prices, although it pointed out that there were also petroleum production and extended grade problems at Escondida, which resulted in disappointing copper production.

"Group EBITDA of US$12,340m was down 44% YoY largely due to the weaker top line. Iron ore’s importance increased with the segment contributing 45% of group EBITDA versus 40% in 2015. Copper, coal and petroleum’s contribution declined marginally. Net income swung to a loss of US$6,385m from a profit of US$1,910m in the prior year. This was largely due to weaker operating margins. The net financial impact of the Samarco incident was US$2.2b."

VSA highlight that capital expenditure was down 42% YoY to US$6,946b due to BHP’s cost cutting programme.

BHP Billiton CEO, Andrew Mackenzie, said:

"The last 12 months have been challenging for both BHP Billiton and the resources industry... Unit cash costs across the Group declined 16 per cent and with increased capital efficiency, supported free cash flow generation of US$3.4 billion despite weaker commodity prices. Next year, we expect another US$1.8 billion of productivity gains as our new Operating Model helps sustain momentum, delivering more than US$7 billion of free cash flow based on current spot prices and a forecast reduction in net debt...

The strength of our cash flow generation and balance sheet is reflected in the final dividend of 14 US cents per share, which comprises the minimum implied by our payout ratio and a top up from excess cash in line with the capital allocation framework...

Over the past five years we have actively reshaped our portfolio, and we are confident we have the right mix of commodities, assets and opportunities to create substantial value over time. While commodity prices are expected to remain low and volatile in the short to medium term, we are confident in the long-term outlook for our commodities, particularly oil and copper."

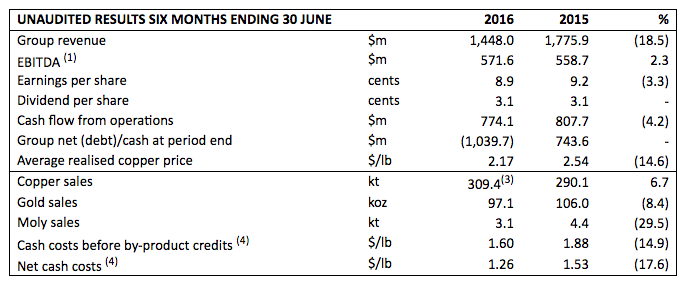

Antofagasta (LSE: ANTO), posted better H116 results than its peer, as the company offset a huge decline in revenues (-18.5%) with major cost savings of $124m. The cost cutting measures resulted in EBITDA of $571.6m, a 2.3% increase YoY, and a strengthened EBITDA margin of 39.5% (26.2% FY15).

VSA said the results showed strong earnings despite a signficant decline in revenue. Analyst Oliver O’Donnell said that despite a 7% increase in copper production, weaker average copper prices and lower gold production had results in an 18.5% decline in revenue.

VSA said the cost cutting measures had helped off set the revenue decline:

"Higher production alongside a weaker Chilean peso was the key driver for the strong cost control. Although operating margins were stronger, net earnings were marginally lower and EPS declined marginally by 3% YoY to US$8.9c/sh."

CEO Iván Arriagada said:

"Continued management actions to reduce costs and preserve cash contributed to our EBITDA margin strengthening to 39.5%, from 26.2% in the full year 2015. While reducing costs in absolute terms is important we are focused on achieving improved efficiencies in a sustainable manner to ensure long-term shareholder value.

Given the current economic uncertainty we are cautious in our outlook and remain conservative in our approach to managing capital. The Board has declared a dividend of 3.1 cents per share equal to 35% of net earnings at the interim, in line with our policy to pay a minimum of 35% of full year net earnings which remains unchanged.

At Los Pelambres, following the agreement reached with the Caimanes community in April, the two longstanding court cases relating to the Mauro tailings dam have recently been resolved. Although an appeal is possible, it is unlikely to be accepted and Los Pelambres and the Antofagasta group now move into a new era of community engagement."

Investors welcomed the Antofagasta results, with shares up 9% in early trading.