Profit warnings from UK's largest estate agent and letting franchise as Gov announces fee ban

Companies: BTRW, BLV, CWD, PSN, PURP

The London housing market is showing clear signs of slowing down, according to the UK's largest estate agent Countrywide.

The day after the UK government announced it would ban letting agent fees for tenants, the FTSE 250 company released a trading update and profit warning, saying the combination of the EU referendum and rising stamp duty had slowed business in London "significantly".

The belief that London is slowing down is shared by housebuilder Barratt Developments in a recent trading update, and the market slowdown in the capital will no doubt "ripple out" to other parts of the UK in coming months.

Countrywide

The UK's largest estate agent, Countrywide, said transactional activity in the residential property market had been challenging. Due to the combination of rising stamp duty on buy-to-let properties and the EU referendum, transaction levels were running "significantly" below 2015.

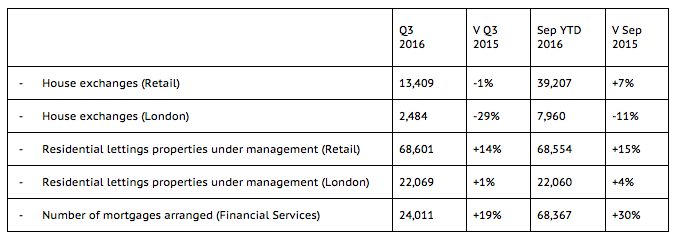

As seen below, exchanges in London fell 29% in Q3 versus the previous year, with 2016 year-to-date figures showing an 11% decline. Nationally the picture is slightly better for Countrywide, with just a 1% fall in exchanges in Q3 and a 7% increase year-to-date:

"The slowdown in activity across the market in Q3 is clearly evident in the closing pipe-lines for our Retail and London businesses, which at the end of September were down 16% and 26% respectively compared to a year earlier."

Countrywide said BoE mortgage approvals had fallen 12% YoY in Q3, and confirmed it now expected transaction volumes for 2016 to be 6% down on 2015, and for 2017 to be even worse:

"...while [it's] too early to say definitively, it is likely that the level of market transactions in 2017 will be lower than 2016."

The lettings market was affected by the rush to beat the changes in stamp duty at the end of Q1, resulting in a larger than usual supply of rental properties, which CWD say has lowered prices in some areas:

"Stock has increased more than tenant numbers, meaning more choice for tenants slowing rental growth, with rents falling in some areas. Overall though tenant numbers have increased slightly compared to last year and we expect the slowdown in the sales market to support the growth in the size of the rental market in the medium term.

Total group revenue for the third quarter was £188.5m, down 4.4% on the £197.1m last year, with revenue for the nine months of the year totaling £558.7m, up marginally from the 2015 total of £535.7m.

The FTSE 250 company said it anticipated the reduced level of market transactions to continue, leading to EBITDA being at the "lower end of market expectations".

CEO Alison Platt, said despite tough trading conditions, the firm had grown its market share in sales and lettings:

"In addition, these results in our Lettings, Mortgage and Professional Service businesses underline the importance of the breadth of the group and the focus we have placed on keeping the customers we win and continuing to serve them. In light of the chancellor's announcement yesterday regarding letting agents' fees, we look forward to working with the Government through this consultation process."

Countrywide's share price fell 12% in early trading.

Industry reaction to ban on Lettings Fees

Purplebricks

New kid on the block, online estate agent Purplebricks, moved swiftly to welcome the Government's ban on fees, saying it would have no "meaningful impact" on business, and positioned itself against of brick-and-mortar letting agents:

"Tenant fees charged by Purplebricks are modest and highly competitive when benchmarked against peers...

Purplebricks anticipates that it can adapt the model swiftly and at minimal cost and when combined with its low fixed overhead model and pricing structure, should prove even more attractive for landlords seeking excellent service and better value."

Michael Bruce, CEO said PURP was built on the ethos of putting customers first and using technology to provide a better service for less:

"The proposed changes to tenant fees represent a significant opportunity to further highlight to landlords the value that Purplebricks is already renowned for offering sellers."

Broker Zeus Capital says it believes Purplebrick's revenue from tenant referencing and administration is a "fraction" of the revenue from its lettings division, contributing less than 5% in FY16. Overall, the ban could even benefit PURP:

"While established letting agents attempt to recover lost revenues by increasing Landlord fees, we expect Purplebricks’ to grow its lettings portfolio and revenues, with its market leading low fees. Arguably the fee ban benefits Purplebricks."

Zeus left its forecasts and valuation unchanged, saying PURP should be valued on a multiple reflecting its growth and business model.

Purplebrick's share price jumped 5% in early trading, reversing the trend that has seen its share price fall 15% since early November.

Belvoir Lettings

The UK's largest property franchise, Belvoir Lettings, said it could not predict the impact on its year-end results in 2017 and beyond, but based on a similar decision in Scotland in 2012 said migrating action should be possible over time:

"...it should be noted that no franchisees were lost in Scotland as a consequence."

According to the Belvoir Board, less than 10% of the income derived by franchisees is from tenant fees, and the impact on Group gross profit is expected to be less than 8%.

"The impact may well be far greater for many of the large number of independent letting agents."

Belvoir's share price fell 5% as the market opened, and has now fallen 15% since its close on Friday.