"Our Analyst Rankings show the most in-demand analysts covering the majority of UK-listed small and mid-cap companies"

It's that time of year again!

After another busy year of growth for our platform during unprececented times and another bumper year of quality research from most of the top Brokers and Research Houses across the city, we publish our fifth Annual Analyst Rankings.

We started these rankings back in 2016 when Research Tree first launched. Since that time our platform has grown to become an increasingly important provider of services to markets. We provide research and financial information to a range of investors from institutions to serious longer tail investors.

The majority of the key UK Brokers, especially at the small and midcap end of the market, distribute via our platform, and we are increasing our presence in larger caps with new partnerships with bulge bracket banks and larger brokers.

Our Analyst Rankings show the most in-demand analysts covering the majority of UK-listed small and mid-cap companies.

If you want to get a clear, data-driven picture of which analysts are being listened to in the market then our RT Analyst Rankings are a powerful starting point.

Our breadth of services has significantly expanded over the last year with an exciting new set of services we are now providing to listed companies and their Brokers. Our research feeds are not just accessible in our platform. They are now available across a growing number of listed companies' websites, as well as the London Stock Exchange platform.

These feeds ensure investors can access their research from multiple locations, personalised based on their entitlements, and fully compliant and secure. Ultimately all of this is geared towards making sure investors can seamlessly access their research wherever they are.

So who topped our Analyst Rankings last year? Let's find out...

2020 Research Tree Analyst Rankings

Here we show which analysts were the most in-demand, based on the number of downloads across our platform over 2020.

How are the rankings shown?

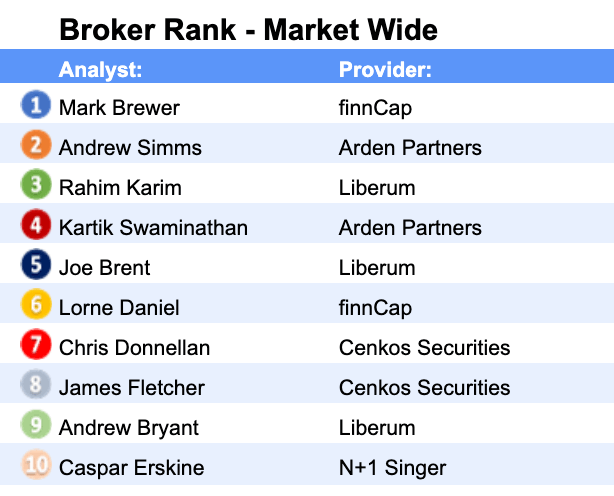

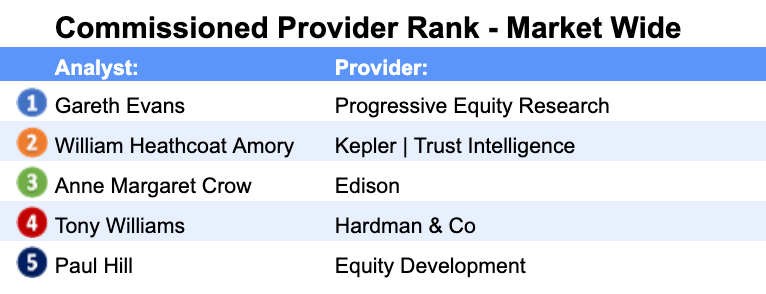

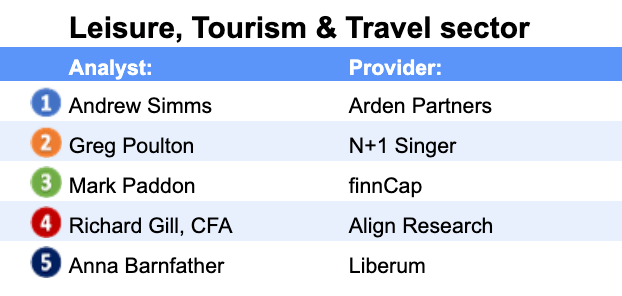

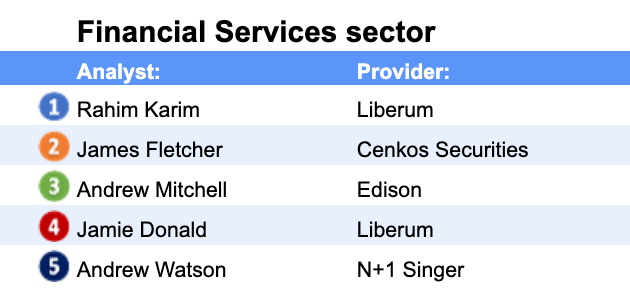

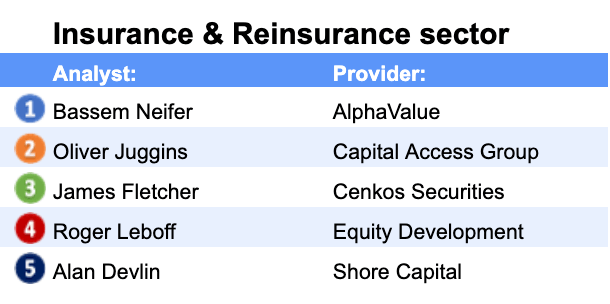

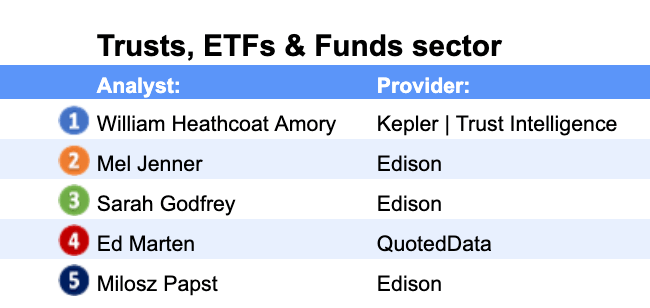

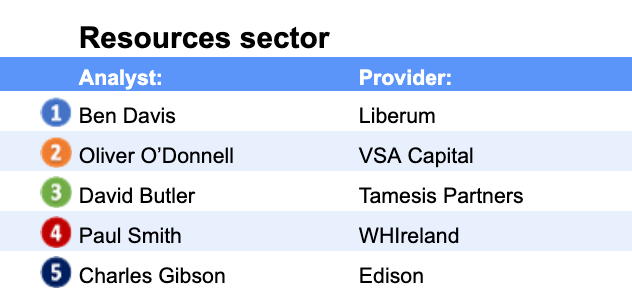

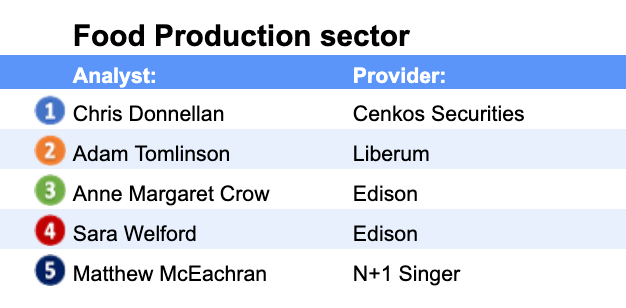

We've published the Top 10 analysts across the entire UK market for Brokers, the Top 5 for Commissioned Providers, as well as the Top 5 analysts for each sector. Our rankings are determined by the level of demand for each analyst's work and are therefore based on real, tangible data taken from Jan-Dec 2020, rather than an easily spoofed voting system.

Why is it important for Investors?

Top analysts shape the way markets thinks about both valuation and risk. These rankings show which analysts were most in-demand over 2020, and who you should be keeping an eye on in 2020.

The rankings are based on platform activity and they break down the most read analysts across the market and within each sector.

Brokers

Congratulations to...

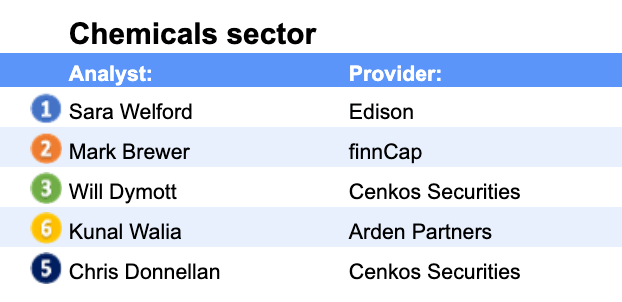

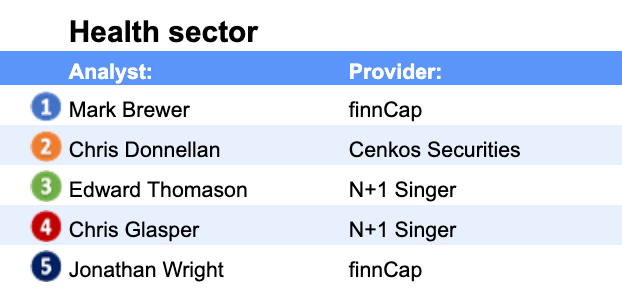

Well done to Mark Brewer of finnCap who jumps to the top of the Market Wide rank for 2020 up from 9th the previous year thanks to his great coverage of the Health sector in particular.

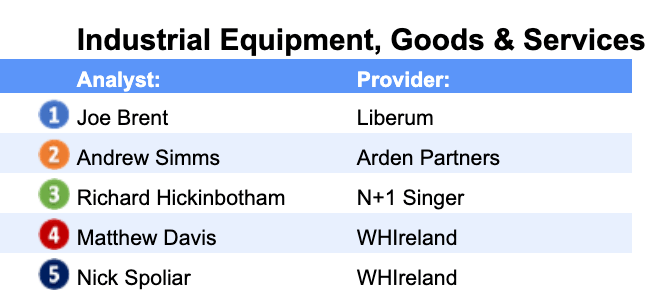

Andy Simms of Arden came in a strong 2nd place overall driven by his coverage across the Industrial Equipment, Goods & Services sector, and the Leisure, Tourism & Travel sector.

Liberum's Rahim Karim also had an excellent year with his coverage of Financial Services including robust coverage of the likes of Plus 500 and Burford Capital.

A huge well done to the wider research teams at Liberum with three analysts placing in the top 10, Arden with two in the top five and finnCap and Cenkos with two in the top 10.

Commissioned Research Providers

This year we have decided to split out the Market Wide rank for the Brokers and the Commissioned Research Providers.

Congratulations to...

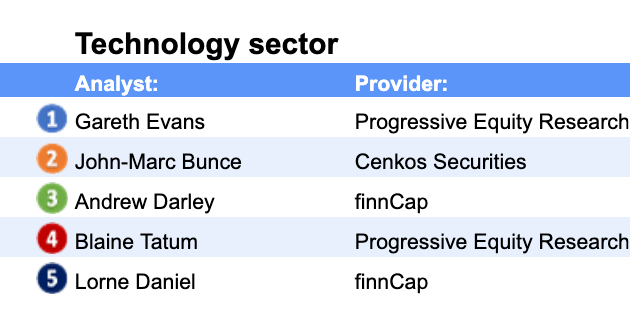

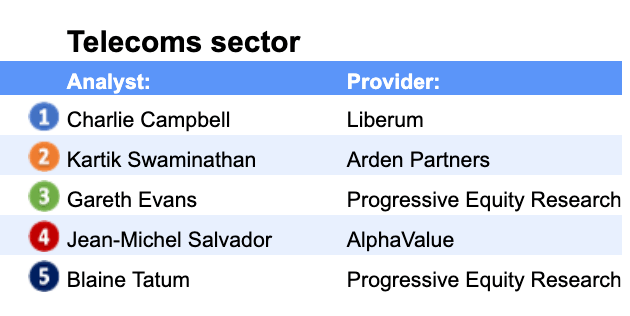

Gareth Evans of Progressive Equity Research. who has delivered consistently strong coverage of the Technology and Telecoms sectors.

Kepler's William Heathcoat Amory had another strong year in the increasingly important Trusts & Funds sector.

Anne Margaret Crow also put in a strong showing for Edison across a number of sectors including Technology.

Sector Rankings

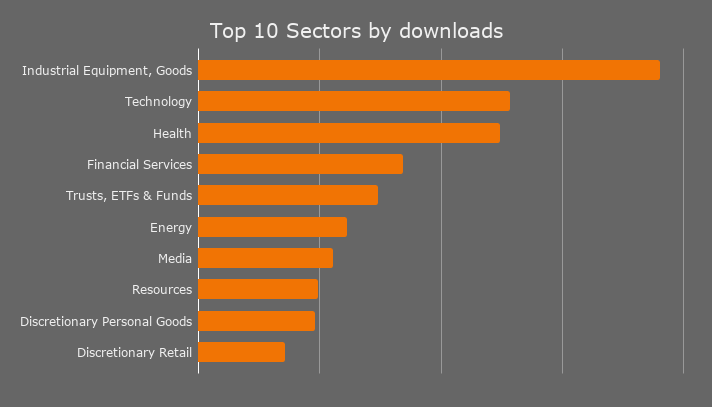

Before we drill into the analyst rankings by sector, we thought we would provide some insight of the relative size of sector this year:

As you can see, Industrial Equipment, Goods & Services has been the standout sector in terms of demand. This sector comprises the following subsectors: Aerospace, Defence, Industrials - General, Support Services, among others.

There is also clearly a lot of demand for Health and Technology sectors, neither of which are a surprise given the last 12 months.

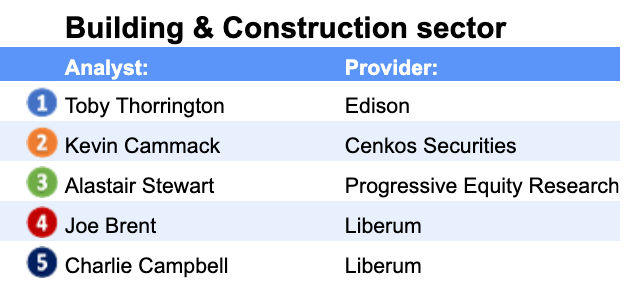

Top analysts across Building & Construction

Top analysts across Industrials & Chemicals

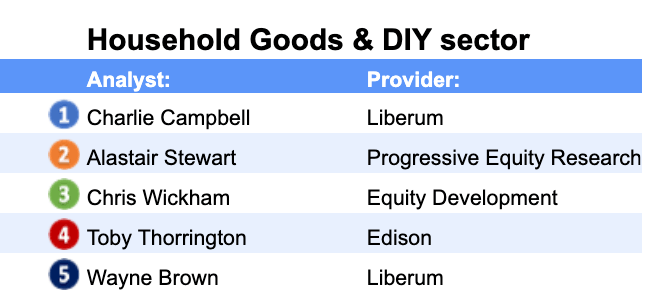

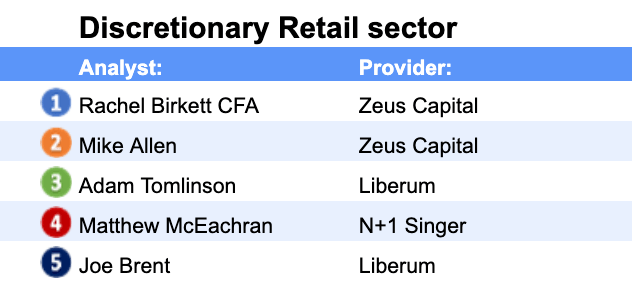

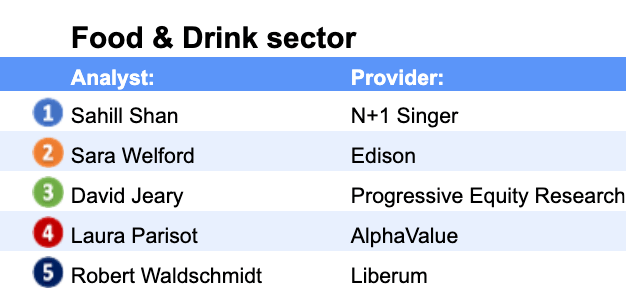

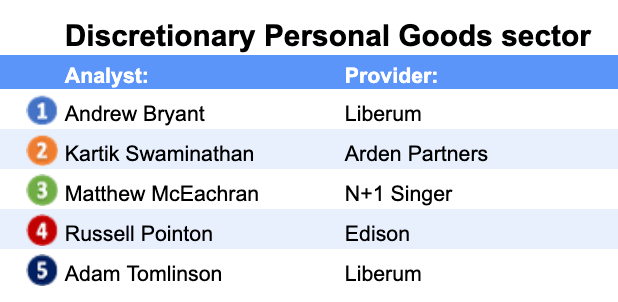

Top analysts across Retail

Top analysts across Finance

Top analysts across Technology, Telecoms, Media & Health

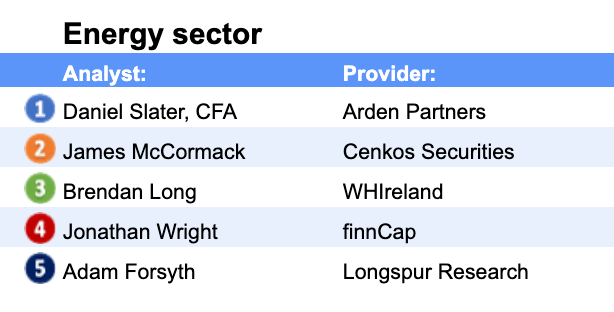

Top analysts across Energy, Resources & Utilities

An important note regarding Brokers who joined us mid-2020

We added a number of quality Brokers and Research Providers over the course of 2020. Our Analyst Rankings span the full 12 months of 2020 and so these Providers did not enjoy a like-for-like comparison of a full year's activity.