See what equity research was trending this week...

Companies: ACSO, GMD, GATC, LRM, PEL, SDXEF, TRI

Featured Report:

Electile dysfunction

By Panmure Gordon & Co

"Although the last two months have seen a broadly neutral performance from the UK healthcare sector compared to a significantly more volatile 6 months prior, we continue to expect macro-events and increased geo-political risk to result in an overall neutral performance from the sector over the next period. However, company specific news is likely to drive a strong outperformance from selected mid-market companies. We retain our neutral sector stance whilst highlighting those we expect to outperform...."

Strong Final Results

Paragon Entertainment (PEL) | finnCap, 20 April

"The group has reshaped its business over the past two years, strengthening management and operational infrastructure, increasing capacity and reviewing strategic emphasis. We anticipate a progressive revaluation given the potential growth profile in an addressable and fragmented international market. Our 2017 forecasts remain unchanged following the results which imply EBITDA growth of 26%, and we raise our target price to 6p, implying potential share price upside of 23%..."

FY17 results ahead of expectations

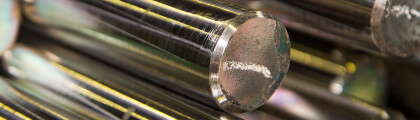

Trifast (TRI) | N+1 Singer, 20 April

"Trifast has provided a positive year-end trading update, with good performances across all geographies. Results for FY17 are guided to be ahead of expectations, with year end net debt also lower than previously expected. FY18 has also started well, although management has reiterated slight caution regarding margins due to rising input costs. We anticipate increasing our PBT forecasts by a mid-single digit percentage, and also reducing our net debt estimates. We remain positive on prospects for Trifast and expect the share price to respond positively today.Trifast..."

Earnings upgrade following acquisition

Accesso Technology (ACSO) | Whitman Howard, 17 April

"Following the recent acquisition of Ingresso we upgrade our estimates by c10% in 2017. Ingresso owns and operates a software platform which enables sales through global third party distribution channels. This looks another smart acquisition by ACSO who continue to create a more efficient flow in the extremely fragmented leisure and ticketing industry. We increase our T/P to 2000p and upgrade to BUY..."

Q1 AIM Oil & Gas Producers review

O&G Sector Note | Zeus Capital, 20 April

"After a substantial improvement from £329 million in 2015 to £684 million in 2016, the pace at which new funds were being invested in the constituents of AIM’s Oil & Gas Producers sub-sector slowed somewhat in the first quarter of 2017. Whether because of flat commodity prices, a dearth of attractive opportunities, or some combination of the two, by the end of the period just £131 million, or £523 million on annualised basis, had made its way into the space. As the chart shows, while this is somewhat better than was achieved in the four years from 2012 to 2015, it is still disappointing in a longer-term context..."

Game Digital (GMD) | Edison, 19 April

"Game Digital (GMD) is a market leader in video gaming with an enviable 32% average share of its two markets. It is executing a major change of strategy aimed at a fuller, experience-based relationship with its customer group, which should bring reduced dependence on the cyclicality of the games market. For the moment management is focused on the transition, while the balance sheet, and hence the dividend yield, is well protected..."

The Tide is Turning

Gattaca (MTEC) | Equity Development, 20 April

"Any investor worth their salt knows it is impossible to precisely call a bottom in a particular stock. For Gattaca, though, we believe this moment has now passed given the compelling valuation (6.9x EV/EBIT vs 9.8x sector average), attractive 9.8% unlevered cashflow yield and constructive secular trends supporting its specialist markets. Sure, Net Fee Income (NFI) like-for-likes (LFL) have fallen of late, yet equally there are now early indications that organic growth may soon turn positive..."

44% organic growth plus £7m of net cash

Lombard Risk Management (LRM) | Equity Development, 19 April

"Many bank executives often complain about the reams of financial red-tape coming out of Brussels, London and New York. Not so Lombard Risk, which this morning delivered what can only be described as a ‘phenomenal’ set of results – reporting FY17 turnover, EBITDA and net cash all substantially above our estimates at £34.0m-£34.4m (vs ED at £31.8m), £2.4m-£2.8m (-£0.4m) and £7.0m (£1.4m) respectively...."

SDX Energy (SDX) | Progressive Equity Research, 19 April

"SDX Energy has provided an update on its SD-1X exploration well in the South Disouq licence where it has a 55% operated working interest. The initial indications are encouraging with the well reaching its first target in the Abu Madi interval. The well has encountered 65 foot of net pay containing natural gas which is in line with predrill expectations where pre-drill estimates of gross mean prospective resources were 490 BCF of gas and 16.3 mmbbl of condensate. Although more needs to be done to determine the actual volume discovered, this discovery should provide a material boost to the group’s reserve base and be significant for shareholders..."