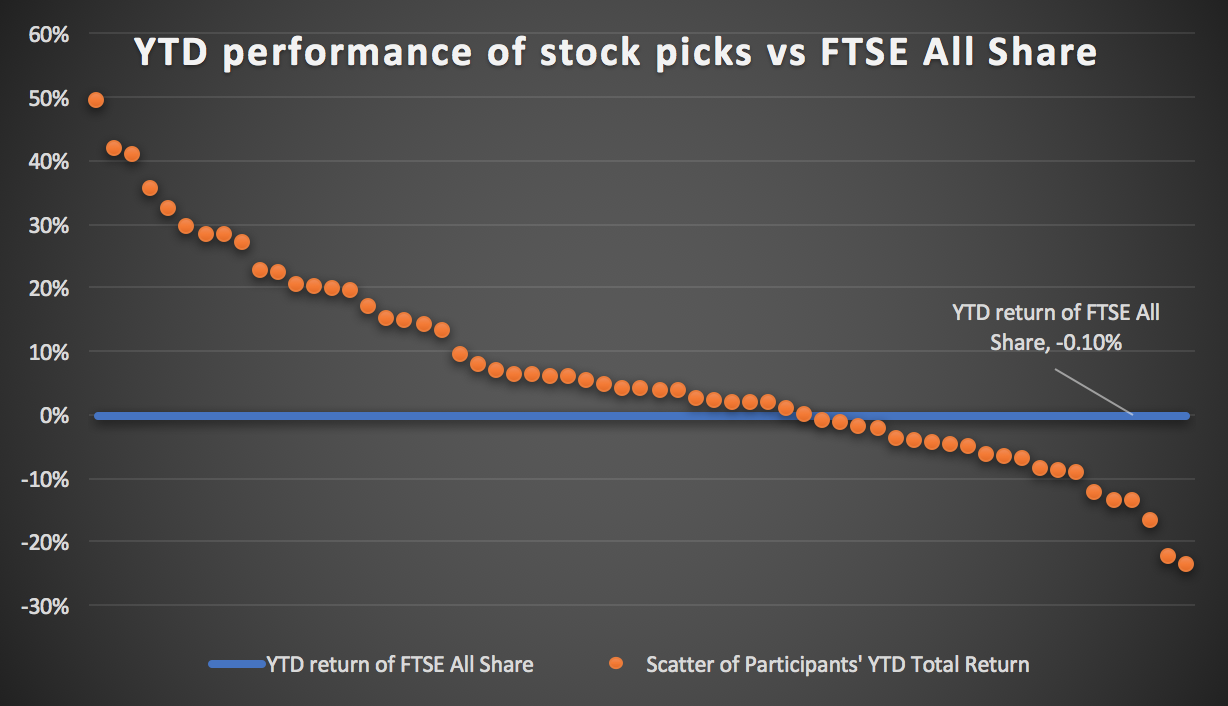

Whilst it's only early days, our users are already comfortably beating the market

Companies: BKY, 5EQ, HCM, MTFB, OPTI, RCH, RED, TLW

As explained below, here are some of Research Tree user's top picks in Energy, Pharma, BioTech, and Publishing sectors for 2017.

At the tail-end of 2016, we asked our core users for their stock picks for 2017 and their associated rationales. We had a fantastic response, and after receiving some excellent insights from a group of very clued-up investors, we decided to share some in a series of articles.

As you can see, the picks as a group are significantly outperforming the FTSE All Share which is currently flat year-to-date, although it is admittedly still early days.

Our users are mostly Sophisticated or High Net Worth private investors, but we also have a growing number of professional investors and commentators.

We thought it would be a good idea to share some of their views and rationales. However, we got so many quality responses that we have had to split them broadly into sector groupings.

Below is a quick run through some of the picks in the Energy, Pharma, BioTech, and Publishing sectors.

Energy

Energy stocks are often popular with private investors for the high rewards they can offer, but with great upside often comes significant risk.

Some of the stocks that our private investors told us they believed would do well are Berkeley Energia, RedT Energy, Tullow Oil, and Enteq Upstream.

Uranium producer Berkeley Energia was a stock that came up several times as a pick, and at the time of writing is up 15% on its December 30th close. One user told us they had picked Berkeley as uranium has been hammered in recent years and they believed Nuclear energy will be very important in the year ahead:

"Berkeley is well placed as a European supplier... most uranium comes from less desirable jurisdictions."

Brokers SP Angel, finnCap, and Hybridan all cover Berkeley Energia

RedT Energy is a little-known energy storage small cap listed on the FTSE AIM market. The company uses vanadium flow technology for off-grid applications. One of our users told us a little bit more about its situation and why he is optimistic about the stock:

"They have recently raised sufficient capital to see them through to a cash positive position and signed agreements with Jabil on the production side.

The Cost of energy storage continues to fall and RedT is in a prime position to establish itself as a major player in this field."

Tullow Oil's share price rose 130% during 2016, reflecting the steady increase in the price of crude, delivery on key projects, support from its primary lenders and progress in East Africa. The chart below shows TLW's recovery vs benchmark crude.

Simply put, one of our users told us he expected Tullow to continue to recover on the back of crude. Clearly, he's hoping OPEC can keep its act together...

Enteq Upstream (NTQ) is another company heavily geared into an oil price recovery. It is an oil field services company and a relative minnow, having a market cap of only £13m, but has more than doubled since July 2016.

"NTQ because the oil price recovery has benefitted other oil support services companies and NTQ trading well below its NTAV of 27p look very cheap"

Pharma

Pharma stocks will be an interesting one to watch this year with so much uncertainty surrounding the policy direction of the US government. Newly elected President Donald Trump's words can make shares in this sector drop in seconds, as happened earlier in January, in the US and the UK.

One of our users gave us their reasoning for choosing Hutchison China Meditech as a pick:

"Shares underperformed in 2016 following the fund raise on Nasdaq in March and therefore do not reflect the progress, and value created, in progressing the developments within its drugs pipeline during 2016, the full implications of which will become apparent as the results of the seven late-stage trials that the company is undertaking are released during 2017.

[I] believe there is considerable scope for outperformance."

Broker Panmure Gordon covers Hutchison China Meditech frequently and just last week said: "we remind investors to continue to be on the lookout for the ‘pivotal’ news flow opportunities due particularly in the first half of 2017."

Another of our users chose Innovaderma as his pick for the year, saying:

"Its Skinnytan product appears to be flying off the shelves, its hair loss product could be a material addition, it is tightly held so positive news sees it move significantly. Not for widows and orphans but so far so good…"

We love the enthusiasm, but sadly IDP hasn't had a great start to 2017 so far and currently sits down 25% despite a remarkable 44% jump in the first 10 days of the year. This is a stock that could move aggressively depending on newsflow. It is very early days but it does appear that Skinnytan is doing well across the Superdrug stores.

Biotechnology

By definition, Biotech is a risky sector. In many ways, it has similar characteristics to pure exploration oil companies. If the drug passes trials, returns are incredible. Otherwise, losses can be severe.

Motif Bio: One of our private investor clients likes Motif Bio, whose shares are down 57% from its August 2016 high, and is currently valued at £50m market cap.

"...[a] highly speculative AIM-listed novel antibiotic (for fighting MRSA-like hospital infections) pharma research company. Recent capital increase (including a Nasdaq listing) has sent [the] stock down significantly and [the] company currently only funded to end of Revive 1 phase3 trial (H1 2017). More funding needed for Revive 2 phase 3 trial (H2 2017). But if trial results are good..."

Optibiotix is another favourite of a Research Tree user.

"Though I don't expect OPTI to gallop early, there are many reasons for it to race ahead in the second half of the year. It has commercial deals with Proctor and Gamble and Tata, which have not been made public by OPTI and there are several products for its cholesterol and hypertension products expected to be launched by spring as well as better than expect sales for its first products using its patented slimbiome used in GoFigure dieting supplements. Its is debt free and cash to see it through for 3 years low fixed cost base which will not rise much and it expects to demerge its Skinbiotix arm in 2017."

Its shares have rallied 24% since the beginning of 2017, so he was wrong about the early gallop.

Publishing

Publishing is a declining sector as digital media continues to eat into profits and cash generation. It didn't take long for the first piece of bad news in the sector with the disappointing profit warning from Pearson, leading to what will likely be a sizeable dividend cut.

Trinity Mirror is one stock that a Research Tree user hopes will buck that trend. The shares are up 50% since its mid-2016 low.

"Trinity Mirror has low valuation ratios and is a safe play in the media sector. The stock price could easily double going forward."

As our user highlights, the shares are currently trading on less than 3x 2016 consensus EPS according to the FT website. That certainly is a low multiple.

-----

Read our users' picks across the other sectors here:

- Tech, Software, and Telecoms stocks for 2017

- Construction, Support Services, and Financial Services stocks for 2017

- Bars & Eateries, Household Goods, and Clothing Retailer stocks for 2017

Please Note: This article is not intended to be advice or a recommendation to buy, sell or hold any investment mentioned, nor is it a research recommendation. Investors should form their own view in relation to any potential investment.