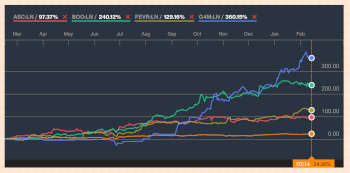

Results for Feb18 smashed expectations and guidance was universally positive, leading to upgrades of >10% as we hoped. While the shares have responded (+23%, 4 weeks), the valuation does not yet adequately capture the high growth and profit dynamics in BOO’s brands. Our detailed analysis of mix, scale economies, and automation savings supports a c10% blended EBITDA margin medium term, albeit not assumed in upgraded forecasts. Sales guidance looks conservative too and, after a “strong start” to F ....

02 May 2018

Leading e-commerce fashion brands undervalued

Sign up to access

Get access to our full offering from over 30 providers

Get access to our full offering from over 30 providers

Leading e-commerce fashion brands undervalued

boohoo group Plc (DEBS:LON) | 20.0 0 0.0% | Mkt Cap: 279.5m

- Published:

02 May 2018 -

Author:

Matthew McEachran -

Pages:

3 -

Results for Feb18 smashed expectations and guidance was universally positive, leading to upgrades of >10% as we hoped. While the shares have responded (+23%, 4 weeks), the valuation does not yet adequately capture the high growth and profit dynamics in BOO’s brands. Our detailed analysis of mix, scale economies, and automation savings supports a c10% blended EBITDA margin medium term, albeit not assumed in upgraded forecasts. Sales guidance looks conservative too and, after a “strong start” to F ....