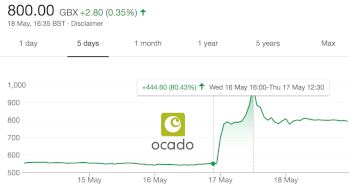

Ocado’s Q3 trading performance was worse than our expectations. The decline in average basket size was the key reason (-6% yoy). Management has downgraded sales / earnings outlook for FY21/22. While the stock price slumped 12%, it is more than justified, considering the low contribution from the retail segment in the group’s valuation. Concerns around softening CFC orders could hold true in the near term, but the pipeline is strong enough. We will decrease the target price but maintain a positiv ....

14 Sep 2022

Weak Q3 performance; tough times ahead!

Sign up to access

Get access to our full offering from over 30 providers

Get access to our full offering from over 30 providers

Weak Q3 performance; tough times ahead!

Ocado Group PLC (OCDO:LON) | 0 0 1.4% | Mkt Cap: 2,214m

- Published:

14 Sep 2022 -

Author:

Nishant Choudhary -

Pages:

3 -

Ocado’s Q3 trading performance was worse than our expectations. The decline in average basket size was the key reason (-6% yoy). Management has downgraded sales / earnings outlook for FY21/22. While the stock price slumped 12%, it is more than justified, considering the low contribution from the retail segment in the group’s valuation. Concerns around softening CFC orders could hold true in the near term, but the pipeline is strong enough. We will decrease the target price but maintain a positiv ....