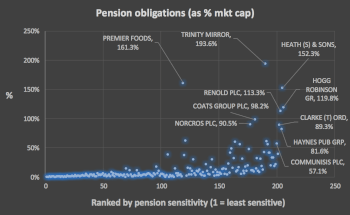

Norcros’s FY23 trading update highlighted a solid performance, particularly in the UK in H2, as well as the closure of the loss-making Norcros Adhesives division. We believe that Norcros’s proven strategy remains on track, which should allow it to unlock significant market share gain and M&A opportunities given its robust balance sheet. We also believe that its key strengths are undervalued and that most, if not all, of the legacy issues, particularly relating to the pension, have been resolved. We maintain our estimates and our 252p/share valuation implying c 40% upside.

14 Apr 2023

Norcros - In-line update highlights undervalued entity

Sign up for free to access

Get access to the latest equity research in real-time from 12 commissioned providers.

Get access to the latest equity research in real-time from 12 commissioned providers.

Norcros - In-line update highlights undervalued entity

Norcros plc (NXR:LON) | 292 8.7 1.0% | Mkt Cap: 262.2m

- Published:

14 Apr 2023 -

Author:

Andy Murphy -

Pages:

3 -

Norcros’s FY23 trading update highlighted a solid performance, particularly in the UK in H2, as well as the closure of the loss-making Norcros Adhesives division. We believe that Norcros’s proven strategy remains on track, which should allow it to unlock significant market share gain and M&A opportunities given its robust balance sheet. We also believe that its key strengths are undervalued and that most, if not all, of the legacy issues, particularly relating to the pension, have been resolved. We maintain our estimates and our 252p/share valuation implying c 40% upside.