Following the success of the consent solicitation announced on 6 January, Avanti’s refinancing is now complete. The company can pursue the strategic development of its satellite network, increasing revenue and cash flow potential. While lower guidance and the refinancing dilute previous cash equity valuations, a significant opportunity for shareholder value creation remains. Our reinstated and revised forecasts produce a current DCF-based fair value standing at 109p per share.

02 Mar 2017

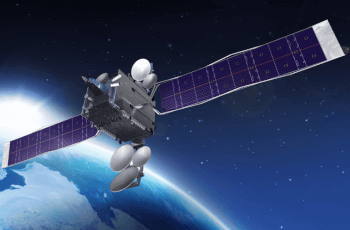

Preparing for launch

Sign up for free to access

Get access to the latest equity research in real-time from 12 commissioned providers.

Get access to the latest equity research in real-time from 12 commissioned providers.

Preparing for launch

Avanti Communications Group (AVN:LON) | 0 0 (-5.1%) | Mkt Cap: 13.6m

- Published:

02 Mar 2017 -

Author:

Andy Chambers -

Pages:

10 -

Following the success of the consent solicitation announced on 6 January, Avanti’s refinancing is now complete. The company can pursue the strategic development of its satellite network, increasing revenue and cash flow potential. While lower guidance and the refinancing dilute previous cash equity valuations, a significant opportunity for shareholder value creation remains. Our reinstated and revised forecasts produce a current DCF-based fair value standing at 109p per share.