This content is only available within our institutional offering.

04 Nov 2024

MT, CMC, CLF, US REBAR, US AUTO, ELECTIONS, ESG

Rio Tinto plc (RIO:LON), 4,374 | BHP Group Ltd (BHP:LON), 1,831 | ArcelorMittal SA (MT:AMS), 0 | Nucor Corporation (NUE:NYSE), 0 | Nucor Corporation (NUE:NYS), 0 | STEEL DYNAMICS (STLD:NYSE), 0 | Steel Dynamics, Inc. (STLD:NAS), 0 | Cleveland-Cliffs Inc (CLF:NYSE), 0 | Cleveland-Cliffs Inc (CLF:NYS), 0 | Commercial Metals Company (CMC:NYSE), 0 | Commercial Metals Company (CMC:NYS), 0

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

MT, CMC, CLF, US REBAR, US AUTO, ELECTIONS, ESG

Rio Tinto plc (RIO:LON), 4,374 | BHP Group Ltd (BHP:LON), 1,831 | ArcelorMittal SA (MT:AMS), 0 | Nucor Corporation (NUE:NYSE), 0 | Nucor Corporation (NUE:NYS), 0 | STEEL DYNAMICS (STLD:NYSE), 0 | Steel Dynamics, Inc. (STLD:NAS), 0 | Cleveland-Cliffs Inc (CLF:NYSE), 0 | Cleveland-Cliffs Inc (CLF:NYS), 0 | Commercial Metals Company (CMC:NYSE), 0 | Commercial Metals Company (CMC:NYS), 0

- Published:

04 Nov 2024 -

Author:

Gresser Tristan TG -

Pages:

12 -

In a nutshell:

. US REBAR (NUE/CMC) - Steelmakers hike offers for the first time in almost a year

. ARCELORMITTAL (+) - Plan of new 18mt greenfield plant in India gets more precise

. CLEVELAND-CLIFFS (-) - Q3 preview: stretching the balance sheet

. US AUTO - October sales increased MoM, inventories continue to rise

. THEMATIC RESEARCH - Trump vs Harris: The Final Countdown

. ESG - Materiality Mapped - Sector by Sector

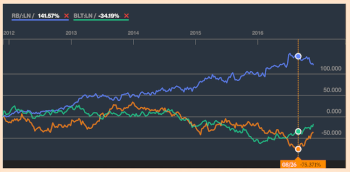

Daily Prices as of November 1

/

PRICE MOVERS

. MACRO/COMMODITY WRAP: China''s National People''s Congress are meeting during November 4-8 to discuss approval of the fiscal stimulus measures. The market is closely monitoring the US Election on Tuesday.

Base metals trading was higher this morning on the SHFE; nickel +1.0%, aluminium +0.3%, zinc +0.8%, copper edged up. Rio Tinto (+) was reportedly in three way talks with Entree Resources and the Mongolian government to reach a deal that would allow RIO to access parts of the OT mine owned by Entree in order to prevent a drop off in grades. Botswana''s new president Duma Boko said on Friday that he wanted to conclude talks for a new sales pact with De Beers, a unit of Anglo America (+).

Iron ore futures slid this morning as the market closely monitor the US election and a key meeting by China''s NPC for cues on stimulus measures.

Gold (USD 2,742/oz) remained below a record high as the market monitor a tight US presidential election that could have a significant impact on economic policy. A 25bps Fed rate cut is 95% priced for November.

. Macro data this week: US Factory orders on Monday, China Exports and Imports on Wednesday, US Nonfarm Productivity on Thursday

. US REBAR - Steelmakers hike offers for the first time in almost a year: According to industry sources, Gerdau followed CMC (+) and STLD (=) in raising rebar prices by USD 30/st last Friday. This marks the first price hike in almost a year and follow similar attempts for plate, HRC and OCTG from other producers in recent...