This content is only available within our institutional offering.

07 Mar 2023

SNAP Back to Reality, Ope There Goes Gravity

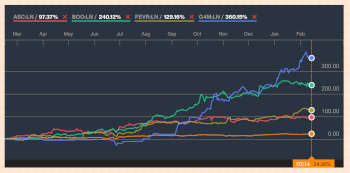

Danone (BN:EPA), 0 | Danone SA (BN:PAR), 0 | Nestle S.A. (NESN:SWX), 0 | Chocoladefabriken Lindt & Spruengli AG Partizipsch. (LISP:SWX), 0 | Reckitt Benckiser Group plc (RKT:LON), 5,035 | Unilever PLC (ULVR:LON), 4,498 | Kellogg Company (K:NYSE), 0 | Kellanova (K:NYS), 0 | Hershey Co (HSY:NYSE), 0 | Hershey Company (HSY:NYS), 0 | General Mills (GIS:NYSE), 0 | General Mills, Inc. (GIS:NYS), 0 | Campbell Soup Company (CPB:NYSE), 0 | Campbell's Company (CPB:NAS), 0 | MONDELEZ INTERNATIONAL INC-A (MDLZ:NYSE), 0 | Mondelez International, Inc. Class A (MDLZ:NAS), 0 | J M Smucker Co (SJM:NYSE), 0 | J.M. Smucker Company (SJM:NYS), 0 | Conagra Brands (CAG:NYSE), 0 | Conagra Brands, Inc. (CAG:NYS), 0 | McCormick & Company (MKC:NYSE), 0 | McCormick & Company, Incorporated (MKC:NYS), 0 | KRAFT HEINZ CO THE (KHC:NYSE), 0 | Kraft Heinz Company (KHC:NAS), 0 | Fevertree Drinks PLC (FEVR:LON), 935 | JDE Peet's NV (JDEP:AMS), 0 | Oatly Group AB Sponsored ADR (OTLY:NAS), 0

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

SNAP Back to Reality, Ope There Goes Gravity

Danone (BN:EPA), 0 | Danone SA (BN:PAR), 0 | Nestle S.A. (NESN:SWX), 0 | Chocoladefabriken Lindt & Spruengli AG Partizipsch. (LISP:SWX), 0 | Reckitt Benckiser Group plc (RKT:LON), 5,035 | Unilever PLC (ULVR:LON), 4,498 | Kellogg Company (K:NYSE), 0 | Kellanova (K:NYS), 0 | Hershey Co (HSY:NYSE), 0 | Hershey Company (HSY:NYS), 0 | General Mills (GIS:NYSE), 0 | General Mills, Inc. (GIS:NYS), 0 | Campbell Soup Company (CPB:NYSE), 0 | Campbell's Company (CPB:NAS), 0 | MONDELEZ INTERNATIONAL INC-A (MDLZ:NYSE), 0 | Mondelez International, Inc. Class A (MDLZ:NAS), 0 | J M Smucker Co (SJM:NYSE), 0 | J.M. Smucker Company (SJM:NYS), 0 | Conagra Brands (CAG:NYSE), 0 | Conagra Brands, Inc. (CAG:NYS), 0 | McCormick & Company (MKC:NYSE), 0 | McCormick & Company, Incorporated (MKC:NYS), 0 | KRAFT HEINZ CO THE (KHC:NYSE), 0 | Kraft Heinz Company (KHC:NAS), 0 | Fevertree Drinks PLC (FEVR:LON), 935 | JDE Peet's NV (JDEP:AMS), 0 | Oatly Group AB Sponsored ADR (OTLY:NAS), 0

- Published:

07 Mar 2023 -

Author:

Omanadze Mikheil MO | Stent Jeff JS | Cross Gen GC | Gumport Max MG -

Pages:

8 -

In his 2002 hit ''Lose Yourself'', singer/songwriter Marshall Mathers III rapped ''Snap back to reality, ope there goes gravity''. In our view, these words could well be an apt description of U.S. packaged food volumes in 2023. That is, with emergency allotments of SNAP (Supplemental Nutrition Assistance Program) having ended in February in the remaining 32 states where it persisted, our analysis suggests gravity could help bring packaged food volumes back to earth, so to speak.

SNAP Back to Reality...

Recall that, in March 2020, the USDA approved states to provide SNAP households with extra pandemic-related SNAP benefits known as emergency allotments (EA). While 18 states have since ended EA, Congress passed a law ending EA nationwide after the February 2023 issuance, which means that the remaining 32 states have now issued their final EA. As such, SNAP households now must face a new reality in which they will, on average, have ~$170 less a month in benefits.

...Ope There Goes Gravity

Our analysis suggests the impact of EA ending could be a significant headwind to U.S. packaged food sales growth. Specifically, we compared sales growth in states where EA already ended vs. those where EA persisted through 2022 -- an analysis we believe isolates out the impact of EA. This analysis suggests EA ending is a -MSD YOY headwind, which, combined with ~3/4th of sales falling in states where EA persisted, implies a ~-3.5% YOY impact to total sales over the next year.

Company Exposure

Of course, some companies will be impacted more than others. Directionally, we think there are two key variables that matter most: 1) the % of total company sales from U.S. retail and 2) the impact of EA rolling off on U.S retail sales (which we estimate by replicating the above analysis at the company level). All in, our analysis would suggest that Conagra and Smucker have the most risk while Lindt, Unilever, Mondelez, Danone, Kellogg, General Mills, and Reckitt have the...