This content is only available within our institutional offering.

17 Sep 2019

Coca-Cola Hellenic : Bubbling away nicely – initiating at Buy - Buy

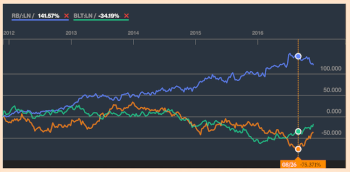

AB INBEV (ABI:EBR), 0 | Anheuser-Busch InBev SA/NV (ABI:BRU), 0 | British American Tobacco p.l.c. (BATS:LON), 4,237 | Coca-Cola HBC AG (CCH:LON), 3,709 | Diageo plc (DGE:LON), 1,662 | Imperial Brands PLC (IMB:LON), 3,180 | Pernod Ricard (RI:EPA), 0 | Pernod Ricard SA (RI:PAR), 0 | Reckitt Benckiser (Bangladesh) PLC (RECKITTBEN:DHA), 0 | Reckitt Benckiser Group plc (RKT:LON), 5,996 | Tate & Lyle PLC (TATE:LON), 366

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

Coca-Cola Hellenic : Bubbling away nicely – initiating at Buy - Buy

AB INBEV (ABI:EBR), 0 | Anheuser-Busch InBev SA/NV (ABI:BRU), 0 | British American Tobacco p.l.c. (BATS:LON), 4,237 | Coca-Cola HBC AG (CCH:LON), 3,709 | Diageo plc (DGE:LON), 1,662 | Imperial Brands PLC (IMB:LON), 3,180 | Pernod Ricard (RI:EPA), 0 | Pernod Ricard SA (RI:PAR), 0 | Reckitt Benckiser (Bangladesh) PLC (RECKITTBEN:DHA), 0 | Reckitt Benckiser Group plc (RKT:LON), 5,996 | Tate & Lyle PLC (TATE:LON), 366

- Published:

17 Sep 2019 -

Author:

Alicia Forry, CFA -

Pages:

28 -

Management raised medium-term guidance at the June 2019 Capital Markets Day. Organic sales growth was increased by 100bps and the operating margin is now expected to expand 20-40bps p.a. beyond 2020. Mindful of increasing health concerns about soft drinks and volatility in emerging markets, our estimates conservatively assume the lower end of the targeted growth range – implying a slowdown of the strong run rate over the last 2 years.

CCH has significantly outperformed the global soft drinks market since 2015, despite its exposure to tricky markets (e.g. Nigeria, Russia). Sugar taxes introduced in Ireland and Hungary were absorbed by the consumer, which gives us confidence that CCH could weather further regulation elsewhere.

Acquisitions are still likely over the medium-term, just not of the scale of CCBA. CCH will struggle to meet the net debt/EBITDA targets without bolt-on M&A or a further significant return of cash to shareholders. There are many small Water and Juice bolt-ons in its markets, and a long tail of small Coke bottlers that should be consolidated over time. A top 3 Coke bottler by volume, CCH is well positioned to participate in consolidation of the Coke bottler network.

Investment view. Our estimates are broadly in-line with consensus, but under a blue sky scenario we estimate EPS could be 24% higher in 2022E; under a grey sky scenario they could be 43% lower. Our DCF shows the shares as fully valued, but our relative valuation analysis suggests further upside; a 3Yr EPS CAGR of 12% is well ahead of the large cap Staples average of 7%. We apply a 21.7x CY20E PE to derive our 3000p target. Next catalyst: Q3 sales (13th Nov).