This content is only available within our institutional offering.

06 Apr 2020

Consumer Goods: The disappearance of OOH

Anheuser-Busch InBev SA/NV (ABI:BRU), 0 | AB INBEV (ABI:EBR), 0 | British American Tobacco p.l.c. (BATS:LON), 4,126 | C&C Group Plc (CCR:LON), 166 | Coca-Cola HBC AG (CCH:LON), 3,708 | Diageo plc (DGE:LON), 1,920 | Imperial Brands PLC (IMB:LON), 3,122 | Pernod Ricard (RI:EPA), 0 | Pernod Ricard SA (RI:PAR), 0 | Reckitt Benckiser (Bangladesh) PLC (RECKITTBEN:DHA), 0 | Reckitt Benckiser Group plc (RKT:LON), 5,768 | Tate & Lyle PLC (TATE:LON), 507 | Unilever PLC (ULVR:LON), 4,624

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

Consumer Goods: The disappearance of OOH

Anheuser-Busch InBev SA/NV (ABI:BRU), 0 | AB INBEV (ABI:EBR), 0 | British American Tobacco p.l.c. (BATS:LON), 4,126 | C&C Group Plc (CCR:LON), 166 | Coca-Cola HBC AG (CCH:LON), 3,708 | Diageo plc (DGE:LON), 1,920 | Imperial Brands PLC (IMB:LON), 3,122 | Pernod Ricard (RI:EPA), 0 | Pernod Ricard SA (RI:PAR), 0 | Reckitt Benckiser (Bangladesh) PLC (RECKITTBEN:DHA), 0 | Reckitt Benckiser Group plc (RKT:LON), 5,768 | Tate & Lyle PLC (TATE:LON), 507 | Unilever PLC (ULVR:LON), 4,624

- Published:

06 Apr 2020 -

Author:

Alicia Forry, CFA -

Pages:

4 -

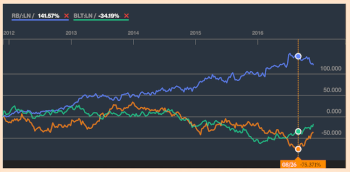

Quantifying the impact: Most companies have not yet quantified the impact of COVID-19 on FY expectations. Pernod and Remy are the notable exceptions – both expect a profit decline of at least 20%, the most dramatic annual decline these companies have ever experienced. We believe Spirits will be the most negatively affected category of Consumer Goods; other categories are likely to see less substantial downgrades. See the table overleaf for a summary of the risks to numbers across our coverage, assuming shutdowns last for 4 months of the year or a more extreme 6 months.

Minimal exposure: Some companies will be unaffected by these lockdowns. Tobacco is still classed as an essential item available for purchase in nearly all markets; both BAT and Imperial have recently re-confirmed FY20 guidance. Reckitt has no meaningful exposure to the out of home & on-trade channels. It is possible these 3 companies may see an uplift in FY20 sales and EBIT as consumers stockpile.

Further updates are due from the sector in the coming weeks. The Q1 reports have already begun, with Beiersdorf announcing last week (Q1 Consumer LFL was -3.3%); the company did not quantify the COVID-19 impact for the FY, however. Towards the end of April, companies may have a better idea of the potential impact on their businesses.

Balance sheet strength: We do not foresee any significant balance sheet issues in our coverage universe – ABI perhaps being the one possible exception on over 4x net debt/EBITDA at the end of 2019 with significant exposure to channels that have shut down (but even there we think the company will find solutions). None of our covered companies have cut their dividends yet. We note that ABI, Pernod, Imperial and C&C have all successfully raised additional funding in recent days. Deals are still happening, too, remarkably; these include Nestlé for Lily’s Kitchen, Unilever for the GSK consumer healthcare & nutrition brands and L’Oréal for the Clarins fragrance division. We have no doubt that the companies on our coverage list will all still be operating in a year’s time, the question is how bad does it get before it gets better?

Our published forecasts and target prices are under review for a number of the stocks in our coverage.