This content is only available within our institutional offering.

22 Aug 2022

UK pubs and restaurants: Pubs and restaurant closures accelerating

Marston's PLC (MARS:LON), 39.0 | Mitchells & Butlers plc (MAB:LON), 268 | J D Wetherspoon plc (JDW:LON), 707

Sign in

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

This content is only available to commercial clients. Sign in if you have access or contact support@research-tree.com to set up a commercial account

UK pubs and restaurants: Pubs and restaurant closures accelerating

Marston's PLC (MARS:LON), 39.0 | Mitchells & Butlers plc (MAB:LON), 268 | J D Wetherspoon plc (JDW:LON), 707

- Published:

22 Aug 2022 -

Author:

Roberta Ciaccia | Darren Milne -

Pages:

4 -

High rate of pubs and restaurant closures in the UK since March 2020. The new Market Recovery Monitor from CGA by NielsenIQ and AlixPartners was published at the end of last week. Among its key findings is that one in seven pubs and restaurants have been closed in the City of London since COVID-19, meaning a 14% decline in numbers since March 2020. This is a steeper decline than London as a whole, which saw a 10.5% fall between March 2020 and June 2022. This clearly implies that closures have been particularly high in parts of central London that are dependent on office workers, as well as foreign and domestic tourism. Similar trends have been observed in other key city centres, such as Manchester (-4.5%), Edinburgh (-5.3%), Glasgow (-10.0%) and, to a lesser extent, Liverpool (-1.3%).

Pubs and restaurant sales have remained resilient through July 2022. The latest CGA data reported total sales up 7% for pubs and 4.8% in restaurants, respectively, versus July 2019, with LFLs down 0.6% for pubs and up 1.3% for restaurants. These are quite resilient numbers, given the negative impact of the heatwave and transport strikes, also evidenced by the 8% fall in dining-in during the month (delivery and collection were net beneficiaries of the hot weather). However, such revenue increases are still not strong enough to compensate for double digit cost inflation.

Smaller chains likely to struggle, benefiting established players. In our recent report It's 5 o'clock somewhere (Aug 8th), we analysed the key success features for pubs to come through the current consumer crisis. Venues should be located in suburban affluent areas, so to benefit from the working from home and staycation trends, should be mostly wet-led, offer flexible and local menus, premium drinks, and be mostly freehold. Also, we argued that, with the end of VAT and business rates benefits in April and the continuous rise in input costs, we expected most pubs and restaurants to struggle, leaving room for market share increases for the bigger, more solid chains.

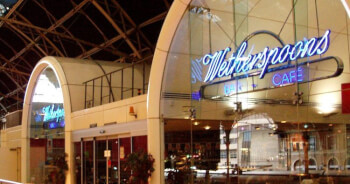

RTN and JDW remain well positioned for the long term. This thesis supports our BUY rating on The Restaurant Group (5.4x CY23E EV/EBITDA, 14.8 P/E), given its strength in the pubs business (17% of FY23E sales), low leverage and proven capacity to out-perform on LFLs. We are also Buyers of JD Wetherspoon (8.5x CY23E EV/EBITDA and 12.9x P/E), given the strong freehold component (68% of the estate) and potential to benefit from undergoing repairs and refurbishments. Through Investec Searchlight, we also follow Mitchells & Butlers, Marston’s, Loungers and The City Pub Group. M&B and Marston’s have the best freehold exposure (both 82% of the estate), City Pub benefits from its presence in affluent areas and Loungers from all-day trading model.