Despite the growth, the stock is trading at roughly the same price as yesterday.

Companies: IG Group Holdings plc

Online trading platform IG Group (LON: IGG) has announced its H1 18 Interim results today, outlining the Group's record Revenues and PBT in the six months to November '17.

Revenues jumped 10% to £268m while Operating Expenses slipped 7%. These helped the Group report record Profit Before Tax of £136m, a jump of 29% on H1 17.

Earnings Per Share are also up 30% and an Interim dividend of 9.7p per share will be issued.

Despite the record numbers shares were flat on yesterday's price at c. 784p.

Management has also had to take action in response to the FCA's regulation proposal to tighten rules surrounding CFD's sold to customers. Today's update acknowledged it had responded but no more detail was given.

The update also said the Group had filed applications to form subsidiaries in both Germany and the USA but again not much more was said.

Commenting on the results and the proposed regulation, IG CEO Peter Hetherington said:

"The Company delivered record revenue and record profit before tax during the first half of FY18, and continued to make good strategic and operational progress. The Group is taking action to mitigate the potential financial impact of regulatory change and to position the business so that it will continue to deliver for all of its stakeholders under a more restrictive regulatory environment...

IG supports the objective of regulators to improve retail client outcomes in the industry. The Company's long-held view is that the most effective measure to improve client outcomes is to ensure that the product is only marketed to the right people in the right way. The current ESMA proposals might not achieve this. The disproportionate focus on leverage has caused consternation amongst our large number of retail clients, many of whom have traded for years and wish to continue using our product as they do today."

In an email sent out to IG users recently, the proposals were:

- 30:1 leverage on major currency pairs = 3.33% margin

- 20:1 leverage on major indices = 5% margin

- 10:1 leverage on commodities (excluding gold) = 10% margin

- 5:1 leverage on equities = 20% margin

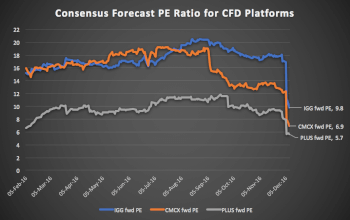

The stock, along with its peers such as Plus500 and CMC Markets, fell sharply late in 2016 when the proposed regulation first came to light. It has since regained much of that lost ground and trades at roughly 20% below its peak before the news of increased regulation.