When investing in platforms, it's important to consider where the value & power lies

Companies: G4M, JE/, 0QZI, 0QYI, TWTR*

The internet has fundamentally changed the playing field for businesses around the world. It has led to the removal of geological and informational constraints that many companies historically relied upon to carve out their economic moats and turn a profit.

What the internet has done is push the value out to both ends of the spectrum and left a tricky middle ground where companies that haven’t adapted (or can’t adapt) are dead, dying or moving towards a low-profit zombie state.

Value has been concentrated either at the small and niche end of an industry where Intellectual Property and specialist expertise protects a company’s economics or at the massive, consumer-facing end where aggregation, ownership of the end-user and network effects are creating monopolies across the sectors. This can be seen by the rise of the platforms.

How Smiling Curves explain the impact of the internet

The Smiling Curve is an excellent framework to look at the new world in which we live, and it’s easy to understand. Smiling Curves were created by the Acer founder Stan Shih back in the early 1990’s and applied to the IT industry. However, it’s applications has become broad with the evolution of the internet. It applies to most customer-facing industries.

The highest value-add resides in companies that either own the IP and design on the left-hand side of the smiling curve, or the owners of the customer through marketing, brand management, etc. on the right-hand side of the curve. The middle part of the curve illustrates the commoditized manufacturing or standardised service providers, where competition and lack of moats drive margins down to utility levels.

Aggregation Platforms by their nature sit on the right-hand side of the Smiling Curve. They effectively aggregate goods or services and offer them to the end-user, providing greater consumer surplus for the user who spends less time looking for what they want, and who often pays a lower price as a result of the platform’s economies of scale.

Which platform models are good and which are bad

However, not all platforms are good businesses from an investment perspective. There are important factors that need to be considered. I will now go on a quick tour of various platforms and why they are good and bad from an investment perspective.

The summary of my ramblings below can be summarised by the sentence: The value in an industry will be captured by those with the greatest economic moat.

Spotify not in a position of strength

Spotify might seem an odd choice to demonstrate an unhealthy market dynamic for a platform. It’s a fantastic service for consumers who can more-or-less access any music they want for £10 per month. That’s what you call consumer surplus! It is looking to IPO (or Direct List) later this year. Surely this is the perfect example of a great platform business for an investor? Well not really.

Music content is controlled by the Big Four record labels (Universal, Sony, Warner and EMI). According to a Neilsen Soundscan report in 2012, 88% of the market is controlled by these four labels. This means the suppliers to Spotify are highly concentrated and therefore command a dominant position in negotiations around royalties.

The other issue affecting Spotify is the nature of the content it sells. The nature of music makes it difficult for Spotify to produce its own content to reduce the influence of the Big 4 labels. Good music is timeless, and this longevity means Labels have enormous power by nature of their back catalogues. If I want to listen to the Rolling Stones, I’m not going to make do with a weak, Spotify-backed imitation.

The connection between an artist and consumer is different in music versus other types of media. Whereas consumers are on a constant journey to find new engaging content in TV and films, we tend to be less on a voyage of discovery with music and stick to the artists we know and love. (Note this is a massive generalisation, but I am characterising the general public rather than aficionados).

Furthermore, other platforms (e.g., Deezer and Apple Music) are waiting in the wings to take over if the Labels decide to pull the plug on Spotify.

Conclusion: Spotify has a weak position with concentrated suppliers, competitors waiting in the wings, and the nature of music content making it difficult to dilute the Record Labels pricing power. Going forward it is in the interest of the Big 4 to keep Spotify limping along as it is a great distribution platform for them, but they will continue to capture the majority of the value.

Netflix in a much stronger position

Another great example of a platform that provides its customers with terrific value for money is Netflix. The movie and TV content aggregator moved faster than the slow incumbents in the industry, inserting itself between the TV / Film Studios and the end user, and replacing the big TV networks as a major distributor of content.

The primary benefit Netflix offered studios in the early days (and still today) was a means of monetising its old content that was gathering dust in the vaults by using its “On Demand” offering. This is a great way for studios to continue monetizing content long after it historically could.

The value of the royalties from Netflix is, therefore, high as it is pure incremental profit for the content owners, i.e., no incremental costs associated with the revenues, which therefore drop straight to the bottom line.

Like Spotify, the primary content providers are a relatively concentrated group including the Hollywood Studios and TV studios.

However, where Netflix differs from Spotify is the type of content being aggregated results in the aggregator holding more of the power. The shelf life of video content is far shorter than music and consumers are on a constant search for new box sets and movies to consume. Therefore the back catalogues carry less weight.

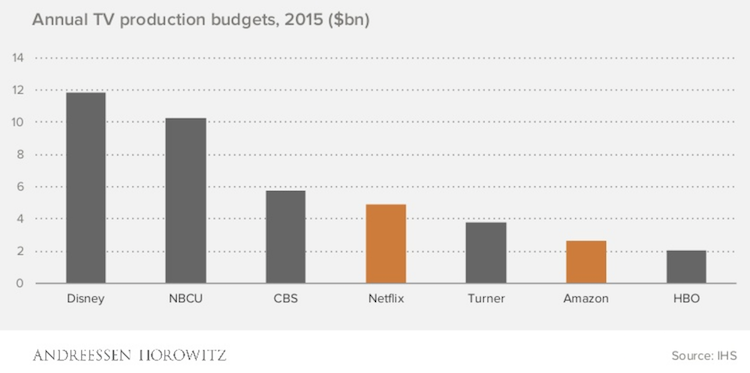

Once Netflix gained scale it then had the firepower to start producing its own content, insulating it from the threat of its providers pulling the plug. Content owners missed the magnitude of the opportunity and the power of the network effects of having the sort of scale Netflix has been able to build. Today, the platform is too big for many content providers not to be on, and Netflix is now one of the largest investors in new content globally.

Netflix spent $6bn on content in 2016 and budgets a similar number for 2017, making it the second biggest investor in content after ESPN, according to press reports.

Conclusion: Netflix is an example of the power of platforms. It provides great value to its users, it allows content providers to monetize old content, and the market dynamics and nature of video content means Netflix holds the position of strength. As an investor, this means a long-term economic moat and profitability, until the next disruption...

That covers music, TV and film.

Social Networks are a mixed bag

Facebook is the giant of all platforms, and one reason is its content providers are most of the people on the planet and are therefore about as dispersed as it’s possible to be. It also maintains its dominance by buying any platforms that look like they could reduce Facebook’s position as principal owner of the networks that socially connect humanity.

Whatsapp and Instagram are examples of two critical transactions Facebook made at prices that looked crazy at the time but, with hindsight, were necessary and wise acquisitions.

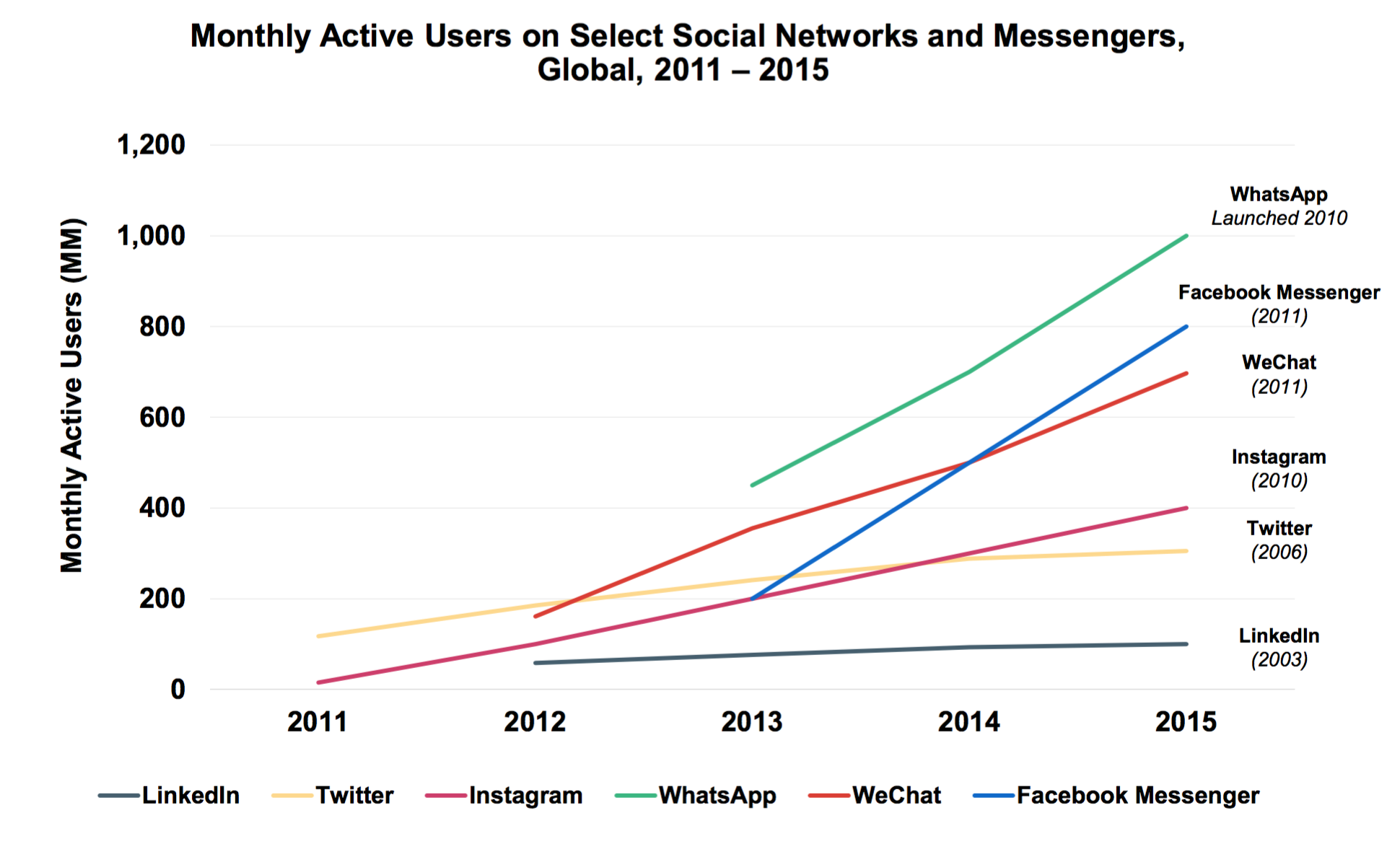

Twitter, on the other hand, has never managed to reach the scale required to command serious advertising dollars. It has failed to innovate, and its offering is not much changed from the early days, whereas user focus has switched from text-based communication to image and video. As a result, platforms like Instagram and now Snapchat have captured market share and engagement of eyeballs.

Twitter is a great platform for power users but it has failed to innovate and grow, and now it is struggling to attract advertising dollars when marketers can instead reach a far wider audience with more precision using the Facebook stable of networks.

Looking at the monthly active users across six of the leading social networks from 2011 to 2015, which doesn’t even include the massive growth of Snapchat, shows Twitter’s troubles. Twitter and LinkedIn have both achieved relatively stagnant growth versus their peers.

The key for social network platforms is scale and engagement. Only the biggest (Facebook and WeChat) are attracting serious advertising dollars at this time. Smaller platforms may need to implement different business models, such as subscriptions if they are to survive.

Quality platforms in the UK

JustEat

Closer to home many companies on UK markets are platforms, and it’s a model I love. There are reasons for caution, as explained above, but picking the right ones will see the perfect virtuous cycle. Networks effects are a powerful thing and the bigger the platform, the more value to consumers, the greater position of power for the platform, and with that, there is a much-improved cash cycle, which often results in strong negative working capital and significant margin expansion.

Just Eat is a great example of a quality platform in the UK and now many other countries. I’ve talked about it before but just to recap, it dominates online food delivery in 12 countries.

The online delivery market in the Western world is dominated by three platforms: Just Eat (UK, Canada, Australasia, Mexico, much of Europe), Delivery Hero (Europe, Asia, LatAm, Middle East) and GrubHub (primarily USA).

The benefits are there for all stakeholders with consumers having an improved user experience and richer offering, the restaurants benefit from increased marketing by being on the platform improving the utilisation of their headcount and fixed assets, and Just Eat creates lots of value for its shareholders.

The nature of the industry with a significant number of small “providers” and consumers puts Just Eat in a very commanding position. This allows it to pay restaurants every two weeks whereas it receives the cash from customers up front. The strong cash cycle means it is a negative working capital business and so the bigger it gets, the more money is generated internally, which means it can invest further on enhancing its product and solidifying its position.

UberEats and Deliveroo are partial competition

These business models are also good examples of decent platforms:

The providers of the food and drink are the restaurants. They benefit from utilising their assets more efficiently. They are no longer limited to the number of covers the restaurant floor can carry, and during quiet nights the demand from the UberEats or Deliveroo clients keeps the chefs and kitchen equipment occupied.

The platforms gain scale and can then lean on the disparate restaurants to enhance its margins. In fact, the restaurants will likely still begrudgingly accept low margins if it means the headcount and equipment are utilised.

The other group that lack power is the workers who lack any pricing power at all. They are readily replaceable, and unfortunately, market forces will probably result in pay levels just above “acceptable”.

Deliveroo and UberEats are also often touted as competition to the Just Eat/Delivery Hero/GrubHub triumvirate. This is partly true as they are competing for wallet spend. However, the price point is much higher, and they don’t compete for the same restaurants.

Gear4Music a growing niche platform

Gear4Music is an interesting platform-based business that aggregates musical instruments and equipment. It started in the UK but has successfully expanded into Europe and is growing rapidly in both markets.

The incumbent competition in the UK is fragmented, being primarily driven by bricks and mortar sales. There are a handful of shops with an online presence and similar scale to G4M, but their stores will likely give them a higher cost structure.

Gear4Music is making rapid progress in Europe, where there are some bigger competitors, such as Thomann.de, which generates over 10x the revenues of G4M. The other obvious competition comes from the giants Amazon and Ebay. However, many suppliers of musical equipment require showroom space, which puts the Amazon and Ebay at a disadvantage regarding the breadth and quality of their offering.

The supplier landscape is far less concentrated than the Spotify and Netflix examples above. There are core suppliers of musical instruments that G4M need to offer to maintain sales and growth, but these providers are larger in number and smaller in size. Furthermore, Gear4Music offers a decent quality own brand of instruments and equipment. Both these factors reduce the risk of G4M being squeezed by its providers, and the own brand range is higher margin.

It is still early days for Gear4Music. It is growing well and looks well set to continue its success in Europe, but it has not yet reached scale to become the dominant platform in its vertical, unlike most of the other examples I’ve expanded on above. It is also still a tenth of the size of its German competitor, online musical equipment retailer Thomann.de.

Overall

Businesses have adapted, died or been born as a result of the barriers that were ripped down by the internet over the last 25 years. The manifestation of this change has been the rise of the Platforms and pushing out where the value is now captured, from the middle to the ends of the Smiling Curve. These platforms are so powerful now they are reshaping how we:

- Shop (Amazon),

- Communicate (Facebook, Whatsapp, Instagram, Twitter),

- Drive/get driven (Uber),

- Holiday (AirBnB),

- Eat (Just Eat),

- Watch video media (Netflix) and

- Listen to music (Spotify).

When investing in these companies, it is important to consider where the value and the power lies, and what economic moat there is to protect and grow margins. Smiling Curves are a great framework to help you consider these questions when looking at a potential investment.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Recent blogs:

- 3 Apr 17 - Bingo player Jackpotjoy offers interesting upside...and risk

- 27 Mar 17 - What Banks and Brokers can learn from Amazon

- 20 Mar 17 - Why understanding behavioural finance is just as important as stock picking

- 14 Mar 17 - What to make of Challenger Banks

- 6 Mar 17 - CFD platforms still worth a look

- 27 Feb 17 - Purplebricks US expansion: How big is the opportunity?

- 20 Feb 17 - M&A - One reason why I’m still bullish on UK equities

- 14 Feb 17 - Anatomy of a growth company

- 6 Feb 17 - Roll-outs: the Good, the Bad and the Ugly

- 30 Jan 17 - How MiFID II could hurt Small and Mid-caps

- 23 Jan 17 - Why Pearson was an obvious value trap, and is Jackpotjoy worth a closer look?

- 16 Jan 17 - How sustainable are current dividends

- 8 Jan 17 - Implications of Trumponomics for equities

- 18 Dec 16 - Millennials - Becoming the most important demographic

- 12 Dec 16 - CFDs - Tough week but worth a closer look

- 5 Dec 16 - Pension deficit dogs starting to look interesting

- 28 Nov 16 - Setting out my stall...plus my thoughts on bond proxies

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.

.png)