The top 20 companies using the CF Growth Profile beat the bottom 20 by 16% pa over last two years

Companies: CRW, INF, IOM, JE/, MCRO, OTB, PTEC, PHD, RKT, REL, RMV, 0GD5, ZPG

Afternoon all,

This week I’ll be looking at a company’s cash cycle. This is a critical factor you need to understand when looking at businesses. I use a very useful framework that measures the free cash generation per unit of revenue growth and examine the whole of the UK listed universe, highlighting a few companies that screen well.

A feature of many great business models is a rapid cash conversion cycle, and the very best even have negative operating working capital. Hence, as their revenue grows, cash generation rises even faster. This is the holy grail for many companies because it means business growth is funded by the customer rather than debt or equity.

There is an excellent book by John Mullins that I would highly recommend called The Customer-Funded Business which goes into customer-funded business models in detail, while still being very readable. It is directed more at startups than established companies, but it does an excellent job in demonstrating the benefits of customer funding and a healthy cash conversion cycle.

Charles Mulford’s “Cash Flow Growth Profile.”

Charles Mulford is a professor at Georgia Tech who has done a lot of work on analysing corporate cash flows. He developed the framework which he dubbed “Cash Flow Growth Profile”. It is an excellent way to systematically look at a lot of companies and get a feel for how much free cash should be generated per unit of revenue growth.

As with many of the best frameworks, it is simple and easy to implement. In short, it puts most of the key moving parts in the cash flow statement in terms of a percentage of revenue and then builds them up to finish with a view of free cash per unit of sales.

Cash Flow Growth Profile = EBITDA margin - Operating Working Capital/Revenue - Capex/Revenue - Tax/Revenue

In English, the above is effectively breaking up free cash flow into the gross cash generation, the working capital burden, the capex and the tax, all as a percentage of revenues. This is a useful framework as it allows you to quickly see how much of a company’s cash generation is down to margin, how much is generated or used by operations via Working Capital, and how much is needed for capex and tax.

Operating working capital as a percentage of revenue shows how much funding is needed to support operations, or critically, how much a business can organically fund growth. It is calculated as Accounts Receivable + Inventory - Accounts Payable.

If the business receives cash upfront from customers but doesn’t pay suppliers for a couple of months, then the cash cycle is highly beneficial in that receivables will be low versus payables and could yield a negative operating working capital position. Greater revenues then lead to higher levels of “float” as Warren Buffett calls it, the best source of internal funding.

How do UK-listed shares stack up?

I have examined the profile of all the equities listed in the UK, both in 2015 and 2016 to see which companies stand out as having a great Cash Flow Growth Profile. As with any of these frameworks, they don’t work for all businesses, so I’ve stripped out negative EBITDA margin companies and those with revenue growth less than 10%. After all, if revenues are growing at a glacial rate or worse, then the benefits of a healthy cash cycle are less relevant to growth.

I also filter out some of the less relevant sectors such as:

- Trusts & Funds,

- Asset Management,

- Biotech,

- Oil & Gas,

- Mining,

- Real Estate,

- Banks, and

- Insurance.

The above filters cut the list of equities from c.1,500 down to c.370 shares of interest. I’ve ranked them from best to worst for each of 2015 and 2016 and aggregated the scores into a combined rank.

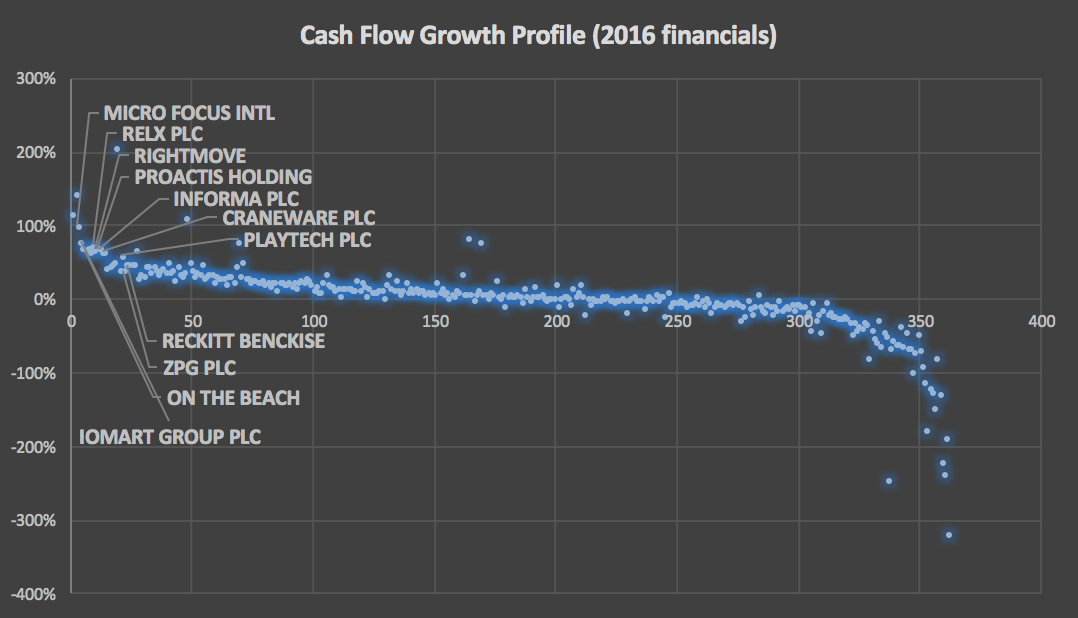

Below are the full results plotted on a scatter graph, plotting the 2016 Cash Flow Growth Profile:

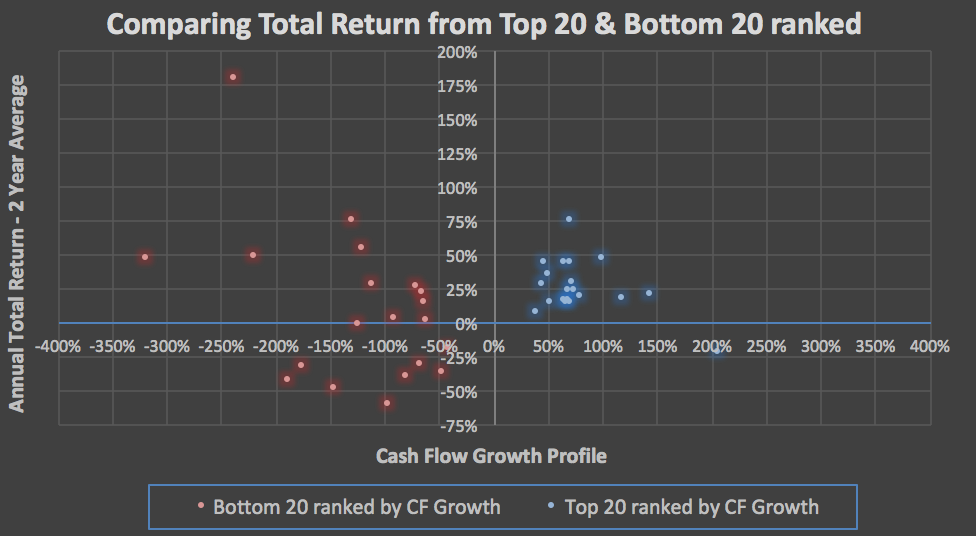

Interestingly if you look at how the top 20 companies (blue dots) in the rank fared over the last two years compared to the bottom 20 companies (red dots), there is a clear outperformance.

The average total return across the top 20 was 26% per annum for the years April 2015-16 and April 2016-17. However, the bottom 20 ranked companies had an average total return of 10% per annum. That’s a 16% outperformance each year.

Furthermore, the clustering is far healthier for the top 20 companies compared to the bottom 20 (which you can see above are all over the place).

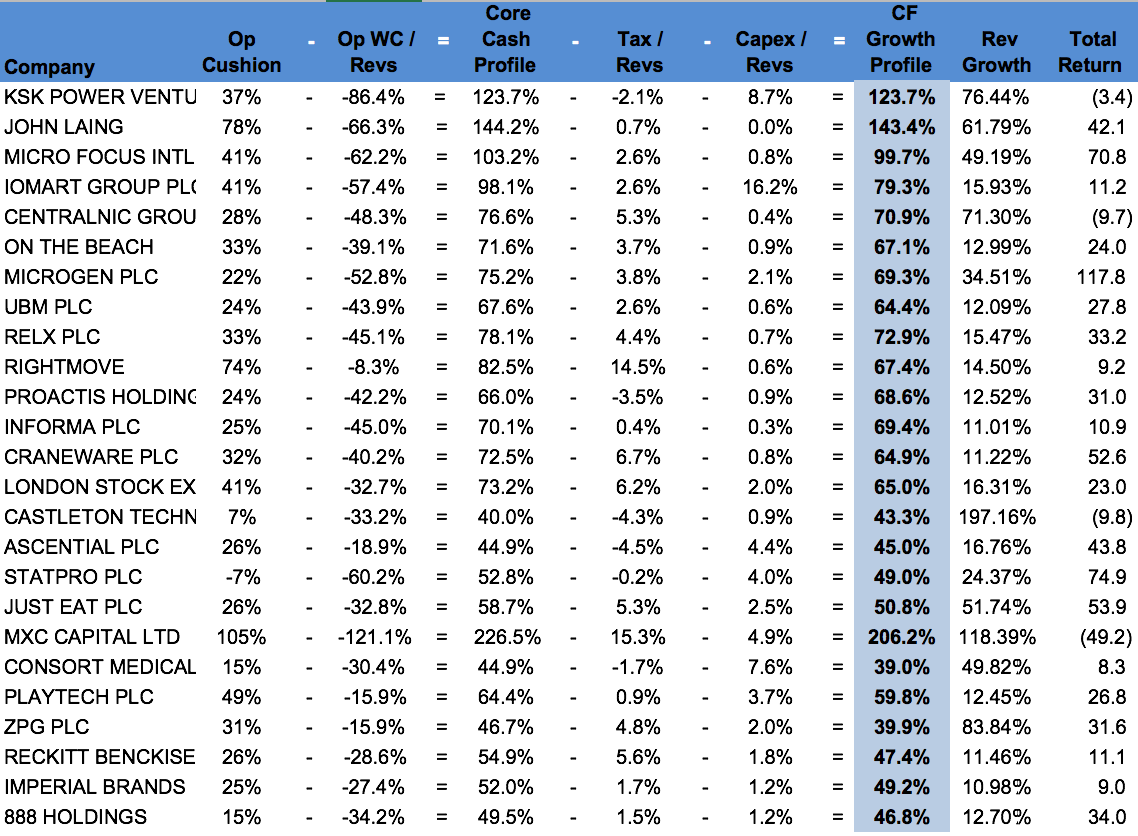

Here are the top 25 companies in more detail:

As you can see, many of these business models have healthy EBITDA margins (or Operating Cushions). What’s more interesting is they all have strongly negative operating working capital positions.

The platform companies unsurprising look good on these metrics with Rightmove, Just Eat and ZPG. JE’s negative operating working capital of -33% is a very healthy cash flow model. ZPG’s is still good, albeit lower at -16%.

On The Beach is another example of a high growth, capital light business whose cash cycle means that 70% of revenues are converted into core cash for the firm, with little in the way of capex obligations to use up that cash.

Iomart is an exciting cloud services consultancy with decent EBITDA margins of 40+% and a negative working capital model (although the numbers are slightly flattered here by a high current borrowings figure).

UBM is a global event organiser. Its business model generates an ok EBITDA margin of 24%, but cash is received more or less upfront from customers and not paid to suppliers til much later, driving a 44% of revenues converting into core cash.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Recent blogs:

- 10 Apr 17 - Platforms are taking over the world

- 3 Apr 17 - Bingo player Jackpotjoy offers interesting upside...and risk

- 27 Mar 17 - What Banks and Brokers can learn from Amazon

- 20 Mar 17 - Why understanding behavioural finance is just as important as stock picking

- 14 Mar 17 - What to make of Challenger Banks

- 6 Mar 17 - CFD platforms still worth a look

- 27 Feb 17 - Purplebricks US expansion: How big is the opportunity?

- 20 Feb 17 - M&A - One reason why I’m still bullish on UK equities

- 14 Feb 17 - Anatomy of a growth company

- 6 Feb 17 - Roll-outs: the Good, the Bad and the Ugly

- 30 Jan 17 - How MiFID II could hurt Small and Mid-caps

- 23 Jan 17 - Why Pearson was an obvious value trap, and is Jackpotjoy worth a closer look?

- 16 Jan 17 - How sustainable are current dividends

- 8 Jan 17 - Implications of Trumponomics for equities

- 18 Dec 16 - Millennials - Becoming the most important demographic

- 12 Dec 16 - CFDs - Tough week but worth a closer look

- 5 Dec 16 - Pension deficit dogs starting to look interesting

- 28 Nov 16 - Setting out my stall...plus my thoughts on bond proxies

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.