Producing E&Ps like AMER can bring interesting risk-reward profiles. Analysts & Market look to be pricing for the downside...

Companies: Amerisur Resources

Afternoon all,

Oil prices have been on a tear so far this year (much to this commentator’s surprise) and correspondingly many UK-listed oil related shares have gained significantly year to date.

Therefore, I thought it might be of interest to briefly outline how I think about an Oil & Gas Exploration and Production (E&P) company.

How to look at a company like Amerisur

One laggard that is in our fund (so I fully accept mine is a conflicted view) and has taken a hit this morning is Amerisur. The shares are broadly flat on a 12-month view, compared to Brent which has steadily risen 65% over the same period.

How do production and the Balance Sheet look?

Amerisur is a Colombian-based but AIM-listed business. It has a market cap of US$270m and a net cash balance sheet of US$39m. In 2017, production averaged 4,857 bopd (Barrels of oil per day) with an exit rate at year-end of 6,951 bopd. That delivered revenues of $92.5m and Operating Cash Flow of $30m. That’s a market valuation of exactly 9x reported Operating Cash Flow.

Management usefully publish their production every month. Frequent and regular transparency is paramount when looking at these sorts of companies and this level of disclosure is a real rarity in the sector. It is to be applauded.

Amerisur has averaged around 6,100 bopd for the first five months of 2018. Although today’s announcement for May shows there have been production issues such as lower production rates and increased water cut, meaning May’s oil production was only 4,800 bopd. This hit shares c.9%.

What are Management planning on drilling this year?

Whilst we are now in June and Amerisur has so far not drilled a single well, Management are hoping to complete 14 wells by 2018 year-end in a $61m capex program; a significant investment amount when set against their existing market cap. This second-half-weighted drilling campaign should generate a veritable avalanche of upcoming news flow.

The recent AGM presentation gives an excellent overview of the business and planned drilling campaign:

http://www.amerisurresources.com/investor-centre/reports-and-presentations,

and is useful to have to hand when reading this.

One thing that attracts me most to Amerisur and this drilling campaign is that, if successful, nearly all of the wells can be rapidly hooked up onto production rather than suffering from a long lead time to cash flow as often can be the case for smaller oil stocks.

The three wells at Platanillo all focus on the N sand opportunity and are drilled from a single pad that has capacity for six wells from this location. The first two wells are vertical and an excellent result for each would be 1,000+ bopd whilst a poor number might be 200 bopd, both eventualities are quite possible; the third well is a horizontal well and these usually, as a rule of thumb, produce something like a factor of 3x the uplift compared to a vertical well if successful. This gives a rough range of 1,000-5,000 bopd from these three wells.

However, with drilling the concept of a "sure thing" does not exist. Therein lies a big part of the risk and the opportunity that markets price into companies like this. Amerisur do operate in a relatively low risk area, as compared to oil basins in other regions both onshore and offshore. According to management, the average success rate since 1966 of a well bringing oil to surface is 85% in the area. Another caveat though, “bringing oil to surface” is not the same thing as flowing commercial barrels.

If all three wells came in it’s likely management would continue to drill further wells here using up the spare slots on location which would be the best result for shareholders.

Licence CPO-5 (Amerisur owns 30% with ONGC as operator) is also a three well campaign targeting the Indico, Aguila and Sol prospects. Management gives a net 40.58 mmbo (million barrels of oil) estimate for all three wells combined, and it flags this estimate as conservative.

Two interesting facts about these wells are:

- Firstly, the nearby Maripasa-1 well was previously a success, testing at 5,400 bopd but choked back to 3,000 bopd of current production from only 10ft of perforation, out of 110ft of pay depth. Since initial production in November 2017 there has been no drop in pressure or flow at all and it could be that this producing asset has much better sizing than initially appreciated. The 10ft of perforation is likely to be increased by another 22ft which should, therefore, increase the wells production rate.

- Secondly, in the block to the north (LLA-34) are a series of producing fields (combined production 55,000 bopd) owned by Geopark and Parex. Through a series of successful drilling campaigns these fields have significantly increased in resource and production in the last three years.

Amerisur’s three drilling prospects are all on trend but focused on different structure types which have been somewhat derisked by their similarity to the successful Mariposa-1 well. Any success from each of these wells could make a significant difference to valuation. It’s worth noting that Geopark has taken its Colombian production from 3,440 bopd in 2012 to almost 22,000 in 2017, mainly on the back of its assets to the north of CPO-5.

Putumayo 8 (50% ownership) sits to the west of the currently producing Platanillo block and the all important OBA export pipeline. Here AMER is due to drill two wells, the first one is actually being drilled from their neighbours existing and producing oil pad but into Amerisur’s block meaning any success can be brought onto production rapidly whilst the second well has a choice of two objectives and a final decision will be dictated by results from the Platanillo drilling (mentioned above) and the first well in the block. The two choices are an N-sands large look alike (number 3 in presentation, page 19) which would most likely be favoured if the drilling of the North of Platanillo licence proves successful, whilst the smaller Bienparado would be drilled otherwise, as a similar play to existing Platanillo production nearby.

Lastly Amerisur has Putumayo 12 (60% working interest) and 9 (100% ownership) blocks both with three well drilling programs and with 2D seismic activity on-going. These wells are slated for later in the year and we shouldn’t be surprised to see a few of these perhaps slip into early 2019, more details are likely to emerge nearer spud date. However with a combined net to Amerisur prospective 289 mmbo there is a large potential prize waiting any drilling success from these six planned wells.

Slide 24 is worth a glance with Putumayo 30, Terecay and Tacacho combined having 926 mmbo prospective resources.

If Amerisur can grow its shorter-term cash flows then it has a whole host of prospectivity to drill into through the next three years or so but to really make any inroads in here they need to be a larger business with a bigger balance sheet. Perhaps these land assets might attract a larger balance sheet partner or takeover of the business given current high oil prices.

The success of its own pipeline investment is now becoming clear, so far the opex savings on a quite low average throughput have paid back the capex over only 15 months. However, its real value can only increase if exploration can provide the output to step up throughput to more like 20,000 bopd in a couple of year’s time.

Experienced Management

Long-term, stable and experienced Management are a crucial factor for a business when we’re assessing whether it should be in our fund. Amerisur is in a strong position on this front. CEO John Wardle is based in-country, he has been in place over 10 years and he has a track record of getting things done in a country where this is no easy task. He’s also survived through the cycle as oil prices have ranged from $36/bbl to well over $100/bbl and all the way back down again during his tenure.

Time for the back of an envelope…

Making the VERY rough and arbitrary estimate that seven out of 14 wells and the increased perforation at Mariposa provide 7,000 bopd then current production could double by mid-2019.

Current sell side analysts that provide estimates have well below this sort of production increase in their estimates. Most analysts seem to be clustered around the 7,500-8,000 bopd range for 2019.

See recent notes from GMP FirstEnergy (here) and Arden Partners (here).

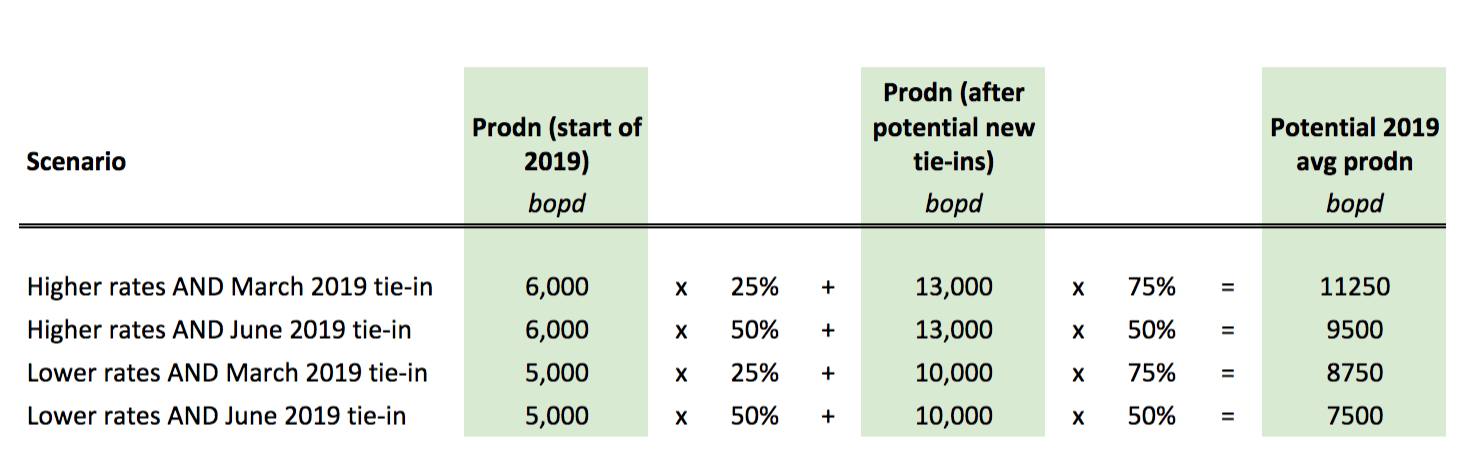

Undertaking some basic scenario analysis, below are four scenarios for 2019 production. The two variables we’ve used are:

- Whether the lower production this month is an aberration or not, in which case we model 2018 exit production at either 5,000 bopd or 6,000 bopd; and

- Whether any drilling success gets tied-in on time around March 2019 or it slips to Mid-2019:

As I say above, the analysts are clustering around 7,500-8,000 bopd and so look to us to be forecasting around the pessimistic scenario.

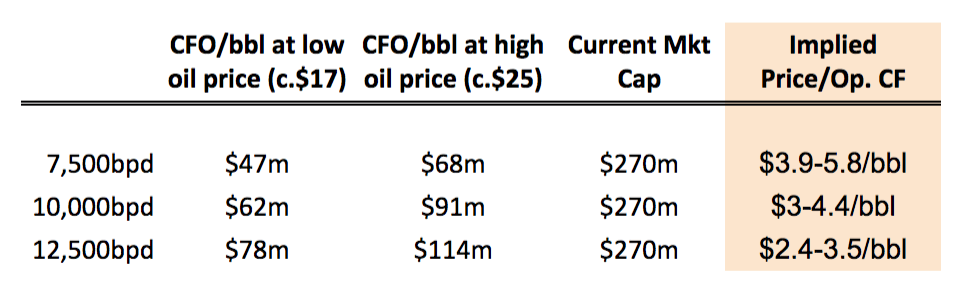

At 7,500 bopd, Cash Flow from Operations (CFO) could range from $47-68m depending on oil prices (assuming they stay in the current 1-year range of $50-$75/bbl). That implies a Price to CFO of 3.9x-5.8x. Not a demanding multiple.

At 10,000 bopd CFO rises to $62-91m, and a P/CFO of 3.0x-4.4x. At 12,500 bopd CFO rises to $78-114m, and a P/CFO of 2.4x-3.5x.

Therefore, the market is, in our view, pricing in even more pessimism than the analysts.

The upside potential relative to downside risk over the next 12 months, combined with the active newsflow, is why we like it.

To conclude

I deliberately chose a share that has production because I’m not a fan of pure exploration plays as candidates for a portfolio. These companies with production and cash generation still bring a lot of risk but the risks are easier to understand and the cash flow allows these companies to survive when there is an inevitable slump in oil prices.

As I outline above, there is a lot of subjectivity in shares like Amerisur and we need to be comfortable with those risks before we add them to our fund. The same goes for anyone looking at this sector.

-----

To read a brief outline of how I think about stocks, and what I aim to achieve in this blog, please check out my first blog where I set out my stall.

Recent blogs:

- 3 Dec 17 - The productivity fallacy, plus why Eland Oil & Gas is interesting

- 21 Jun 17 - What changes are needed post Fusionex fiasco

- 5 Jun 17 - Why Labour's Manifesto needs a dose of reality

- 30 May 17 - China shows Western Tech Giants might be stifling innovation

- 8 May 17 - Why corporate chiefs are better leaders than politicians

- 2 May 17 - Why the best businesses have great cash conversion

- 10 Apr 17 - Platforms are taking over the world

- 3 Apr 17 - Bingo player Jackpotjoy offers interesting upside...and risk

- 27 Mar 17 - What Banks and Brokers can learn from Amazon

- 20 Mar 17 - Why understanding behavioural finance is just as important as stock picking

- 14 Mar 17 - What to make of Challenger Banks

- 6 Mar 17 - CFD platforms still worth a look

- 27 Feb 17 - Purplebricks US expansion: How big is the opportunity?

- 20 Feb 17 - M&A - One reason why I’m still bullish on UK equities

- 14 Feb 17 - Anatomy of a growth company

- 6 Feb 17 - Roll-outs: the Good, the Bad and the Ugly

- 30 Jan 17 - How MiFID II could hurt Small and Mid-caps

- 23 Jan 17 - Why Pearson was an obvious value trap, and is Jackpotjoy worth a closer look?

- 16 Jan 17 - How sustainable are current dividends

- 8 Jan 17 - Implications of Trumponomics for equities

- 18 Dec 16 - Millennials - Becoming the most important demographic

- 12 Dec 16 - CFDs - Tough week but worth a closer look

- 5 Dec 16 - Pension deficit dogs starting to look interesting

- 28 Nov 16 - Setting out my stall...plus my thoughts on bond proxies

Please Note: To be clear, I do not and will not ever give any advice. I will rarely mention individual stocks but when I do these will not be recommendations, instead just my thoughts at that point in time.